June 14, 2021

What Is SWIFT’s Transaction Manager and What More Is Needed to Ace ISO 20022 Transition?

The ISO 20022 migration and SWIFT Transaction Manager: how do these two major industry topics fit together? While the answer might appear obvious, there are quite a few things to consider. Before I dive into the details, let me share a personal observation from my private life, which perfectly describes the link between ISO 20022 and the SWIFT Transaction Manager.

I am the proud father of a little daughter who just recently learned to walk by herself. Although we both can walk, naturally, she is still slower than me and requires help for long distances. For this, I am very happy that somebody invented the baby buggy, which allows us to move at the same speed.

One cannot compare our payment industry with the challenge of a little one trying to catch up, but still different parties of the industry are moving at their own pace and – to be more concrete – are implementing ISO 20022 to different timelines. This is where the SWIFT Transaction Manager comes into play. It’s a different vehicle from a baby buggy, yet serves a similar goal: in this case, to provide a lift for the slower movers and bridge the various migration speed/timelines of the 11,000 banks.

Transaction orchestrator

When the decision was taken in 2020 to postpone the ISO 20022 migration for cross-border payments in the SWIFT network by one year to November 2022, the dependency on the progress of slower-moving parties was a key consideration. The migration to ISO 20022 can only be successful for the industry if every party can continue executing cross-border payments messages in the format supported by their internal applications. This huge industry undertaking requires a well-managed co-existence period, enabling all banks to upgrade their infrastructure to support ISO 20022 at their own pace. The SWIFT Transaction Manager makes this possible.

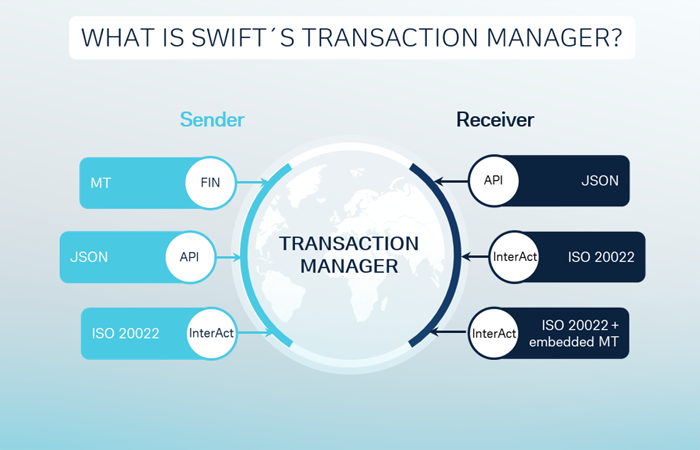

With the Transaction Manager, SWIFT is moving away from pure message exchange between different financial institutions and is introducing processing capabilities on a central platform, orchestrating payments on the basis of a central copy of the transaction data. Financial institutions will exchange the transaction data with the central platform, instead of sending it directly to the next party in the chain of a cross-border payment. This enables the usage of multiple message formats and communication channels across the various actors involved in the same transaction, removing the need to use the same data format at the same time. Although the native format of the platform will be ISO 20022, users can continue to use the MT format to send payment messages to the platform until the ISO 20022 migration deadline for cross-border payments in November 2025. More advanced institutions can fast-track directly and communicate with the platform via APIs, moving away from existing message-based communication.

By introducing a central transaction copy, updated with every single action and data input throughout the payment journey, the Transaction Manager enables backward compatibility, providing the full set of data to the receiver and removing the weakest link challenge in the payment journey. Financial institutions not ready for the consumption of ISO 20022 messages will – by default – receive multi-format ISO 20022 messages with the embedded MT message. The latter can be used for processing the transaction if the full ISO 20022 capabilities are not yet implemented, whereas the ISO 20022 part of the message should be used for sanctions filtering and to support other regulatory obligations requiring the full data set.

Despite the great benefit of providing a “translation service” from ISO 20022 to MT and vice versa, which the Transaction Manager is introducing, the real advantage of the platform is the foundation to enable seamless and frictionless cross-border payments. The Transaction Manager is expected to provide pre-validation capabilities to minimise the possibility of any error in the payment up front. While enhancing the tracking capabilities, building on the established SWIFT gpi services to increase transparency and execution speed, it will also foster the roll-out of mutualised central services such as compliance checks and fraud prevention.

Points of attention

Don’t get me wrong, the Transaction Manager is not a panacea that will make the migration to ISO 20022 a non-event. Before we can reap the benefits, let me draw your attention to the most important points:

- Every bank must review and change its messaging interface to support SWIFT InterAct multi-format messages;

- Not all payment messages are within the scope of the Transaction Manager starting November 2022. Complexity will be introduced with some payment related messages to be exchanged outside the Transaction Manager either as MT message, such as MT940/ MT950, or as ISO 20022 message, such as camt.054. You can find the latest overview of messages in the SWIFT´s Connectivity guidance at swift.com;

- Not all messages within the scope of the Transaction Manager will be migrated to the Transaction Manager immediately. Some messages initiated via SWIFT FIN MT will remain on the SWIFT FIN network for a period still to be defined. This requires the maintenance and support of the SWIFT FIN channel by all participants beyond the Transaction Manager go-live;

- The embedded MT message provided in a multi-format message via the Transaction Manager may be different from a native MT message in the current environment. The best example is Field 52 of an MT103 which is blank today when the ordering institution is the same as the sender of the message, but will be populated with the sender BIC, representing the mandatory debtor agent in pacs.008, when delivered via the platform;

- Payment legs processed via a payment market infrastructure will not be processed through the Transaction Manager in a first phase and the implications need to be reviewed on a case by case basis.

At Deutsche Bank, we still appreciate the “baby buggy” benefit of the Transaction Manager to align the migration speed and bridge the gap between faster and slower market participants, which we face even within the Bank. While we are preparing all our locations to become native ISO 20022-ready and upgrade the end-to-end processes by November 2022, the Transaction Manager allows the team to focus on our core clearing hubs in Germany, the United Kingdom and the United States, which are either forced to migrate due to local payment market infrastructures introducing ISO 20022 in 2022 (such as the Eurosystem with TARGET2 and the Bank of England with CHAPS), or are processing critical cross-border payment volumes on behalf of our clients. For smaller locations, the platform provides an alternative and fall-back solution to ensure ISO 20022 readiness in case of any disruption to the project.

Finally, I would like to re-emphasise the importance of implementing ISO 20022 front to back: let´s remain focused and keep this as a priority. The full benefits – such as structured data for higher straight-through processing rates, better compliance controls, etc. – can only be achieved if every party is talking ISO 20022 front to back. The Transaction Manager eases some of the immediate pressure but doesn’t remove the demand to make ISO 20022 the new normal in payments processing.

by Christian Fraedrich,

Head of Cash Business ArchitectureBack