July 26, 2021

Will ISO 20022 Impact Payment Operations?

Before sharing my observations, I should first stress how much change means to me as an Operations manager. It pushes every member of our team out of their comfort zone. When the right preparations are made, it can also open up tangible improvements for us, our clients and our business partners.

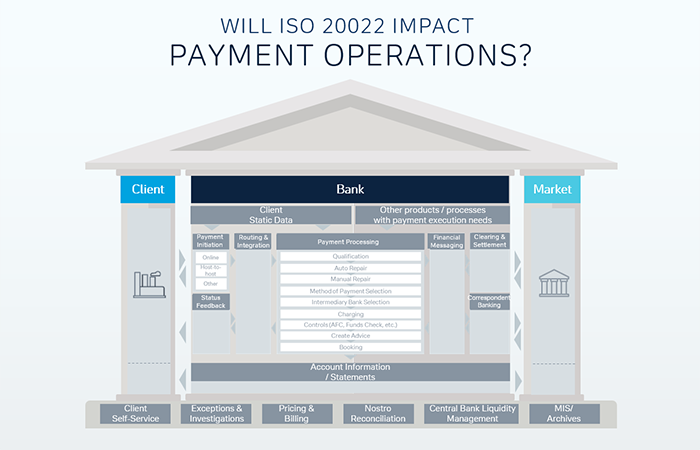

With that in mind, you will doubtless agree that the many ISO 20022 migration projects are keeping our technology colleagues very busy. But they are not alone. The upcoming transition is impacting many teams across our industry – not least in our segment. ISO 20022 is set to fundamentally change the world of Operations and we need to be ready. Ultimately, it will be Operations that handles the day-to-day business and ensures the transition runs smoothly for our clients and counterparties. To be sure of success, however, we need to be involved in the design of the future processes and applications from the outset.

Overnight changes

Here are just a few of the basic changes, with which Operations will be confronted almost overnight:

- The message format and business language, which has been in use for over 40 years, is changing. We will be required to read and understand the new ISO 20022 messages, which have not only been designed and optimised for digital consumption, but also look dramatically different to the MT messages and introduce new terminology, including Ultimate Parties, Instructing Agent, Settlement Method, etc.

- Almost every processing system – used in our day-to-day work – will need adjustment to process and display the new ISO 20022 messages. This not only affects payment and investigation applications, but also the applications and user interfaces used for reconciliation, reporting, funds release, screening, billing, etc. Many organisations, which are implementing ISO 20022 front-to-back, are also in the process of renewing the underlying system architecture, which will likely lead to additional manual touch points for Operations during the migration.

- The new messages introduce changed external and internal business processes, such as the introduction of dedicated return messages.

- The new data granularity and the complexity of the coexistence period with FIN MT in the correspondent banking space require a total revision of operational and non-financial risk controls. Today’s controls and processes must be adjusted in response to the new format, the risk of potentially truncated data by any of the former actors in the payment chain, and to provide access to new data elements for the sake of transaction filtering (e.g. sanctions and embargo) or monitoring (e.g. anti-money laundering).

- New market requirements will trigger adjustments to our operating model. For example, market infrastructures such as TARGET2 and EURO1 are extending their opening hours from 7:00 – 18:00 CET to 2:30 – 18:00 CET, which will require early hour coverage.

If you are an Operations colleague, you’ll know that the list of changes is much longer, and that each market brings its own specific flavour to the migration, but let me stop here. Don’t be misled, these changes are not only affecting the payment processing or investigation teams within Payment Operations. If you are in Trade, Securities, Loans, Reconciliation, Reporting, FX, Equities or any other areas initiating or receiving payments or account reporting, like it or not you are also part of the change.

Prepare for a bumpy ride

To illustrate how a minor data element in the message standard can lead to a new process and additional touch-points for Operations, let me share a recent example from the Philippines (PhiliPass+ local RTGS clearing). With the migration, PhiliPass+ introduced a mandatory Date of Incorporation (DOI) for corporates and Date of Birth (DOB) for individuals acting as the Debtor (payer) in a domestic payment. However, given these were new requirements, which corporate clients must provide at the point of payment initiation, Operations needed to be prepared to both facilitate an adoption period and to troubleshoot when payments arrived without these new data elements. In this instance, the onus was on Operations to intervene, collect the missing information via the Client Service Team and enrich the payment prior to sending it to clearing.

While this is just one example, many other market infrastructures are scheduled to migrate to ISO 20022 over the next few years. And given that many of these are introducing market specifics, and that the SWIFT community with 11,000 banks is supporting a three-year coexistence phase, one can easily appreciate the magnitude of changes coming our way.

As an experienced Operations manager, I remain optimistic, but we need to prepare for a bumpy road ahead. Based on the lessons learned from previous market migrations, we have a good idea of what to expect at the outset:

- Some transactions will fail straight-through processing (STP) because of missing information or incorrect formatting.

- A lack of understanding of the new standards by clients and counterparties, as well as different external processes, will likely mean that the number of investigation cases will rise.

- With markets and market infrastructures following different migration timelines and approaches within a limited period (~three years), Operations will be subject to continuous change of processes – all while continuing to handle the day-to-day business – until the market has fully adopted ISO 20022.

- We also must not overlook the potential migration risk. Major market infrastructures, 11,000 banks, and some of our corporate clients will all be introducing or renewing their infrastructure in parallel. Operations must be equipped and prepared to handle stress situations in case any of the actors in the payment chain run into technical issues – making sure that potential client/business impact is minimised.

Having outlined some of the expected additional efforts, what can be done to mitigate the risk for Operations teams? This is a tricky question to answer – and, depending on the size of the institution, it will likely take a bit of creativity. One option, for example, would be to assess the areas that produce the majority of manual effort today, and assess whether the migration to ISO 20022 will lead to any changes of these processes. If you find that the volume of manual efforts is likely to increase significantly, the only option could be to increase your Operations capacity.

Is it all worth the effort?

Will the benefits of ISO 20022 be commensurate with the pain and effort for Operations? We have all heard the buzz phrases: “richer and more structured data”; “higher levels of automation” and “greater interoperability”, to name but a few. Fortunately, there is substance behind the buzz and, focusing on the perspective of payment operations, I am looking forward to capitalising on the following opportunities:

- Normalise regional and market specific processes towards a global approach.

- We have historically established a multitude of different processes, far away from anything that could be called a “common standard”. The global approach will enable us to simplify, standardise and centralise operational processes.

- Automation of manual touch points within the transaction life cycle.

- Many of today’s processes remain manual (some are even still paper-based). ISO 20022 unlocks a host of opportunities when it comes to automation – and hopefully we can leverage the machine readable standard to eliminate and reduce the number of manual touch points.

- Remove exceptional handling.

- Historically, based on client demand or changed market practices, lots of exception handling were introduced to address special requirements. With the introduction of standardised processes and the granularity of ISO 20022, most of these exception processes can be eliminated or automated, which will help to foster operational efficiencies.

So will all these benefits be available from day one? The answer is a definitive “no”. The focus initially is to make sure our current processes, applications, teams and clients are prepared for the new standard. Once the dust settles, the team will then focus on utilising further benefits of ISO 20022 with the aim of improving the efficiency and eliminating friction.

Finally, I have one favour to ask: Please get your Operations teams involved. Make them part of the project, help them understand what is coming and invite them to contribute to defining the future processes. Ultimately, if you want the team to outperform, they must own the process, rather than being told.

by Torsten Gorny,

Head of SWIFT Messaging Operations and ISO 20022 Operations LeadBack