ISO 20022 information for corporates

The introduction of ISO 20022 payment instructions will affect all corporate clients. Before analysing the individual impact, it is essential to assess what the ISO 20022 migration means for corporates in general and what benefits it will bring.

See Johnny Grimes, Head of Corporate Cash Products, Deutsche Bank explain how regulatory changes represent opportunities to enhance efficiency, transparency, and trust in the payments ecosystem.

At Deutsche Bank, we are here to help our clients navigate these regulatory shifts, offering solutions for real-time payments, fraud prevention, and seamless ISO 20022 migration.

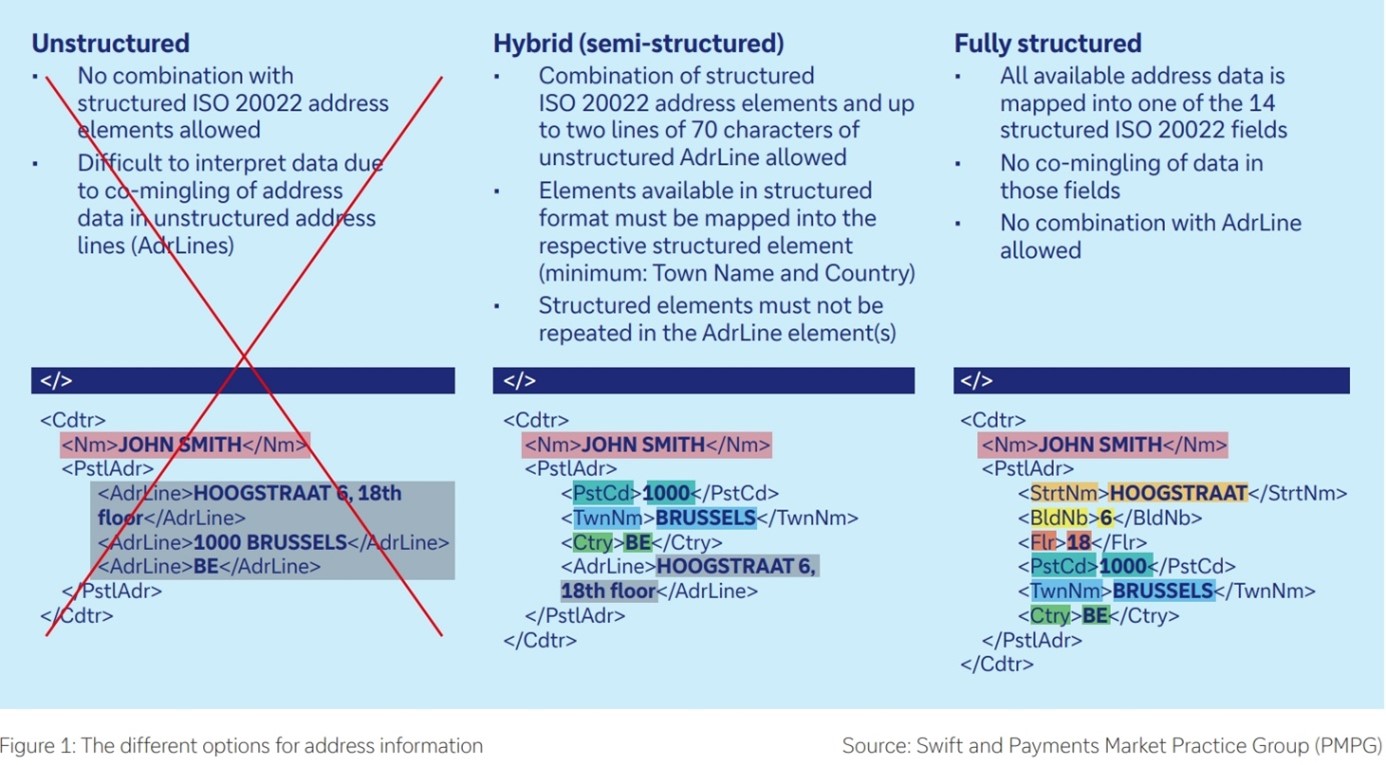

Over the past few years, the ISO 20022 migration has been focused on interbank messaging. Today, we are pivoting towards client adoptions to prepare the market for the deadline of November 2026. For the applicable payment types, corporates need to be prepared to send i) fully structured or hybrid postal address (at a minimum country and town information as structured elements); and where applicable ii) regulatory information; and iii) ultimate creditor / debtor information in their XML-based payment formats.

The new ISO 20022 based formats will not only enable more efficient payment processes across the financial network, but also facilitate improved internal reconciliation processes of payments and account statements.

Corporates will have to ensure their processes support generating and storing structured address information and have payments processing systems in place that can generate pain.001 messages.

The figure on the right (click to enlarge) illustrates the requirements for fully and hybrid structured postal address information:

To send structured addresses, corporates will need to move to XML-based pain.001 messages latest by November 2026. Please note that support for non-XML message formats, such as MT101, IDOC, EDIFACT, DTAZV, or older XML messages like pain.001 v2 will be discontinued. Hence, corporates should prepare to migrate to pain.001 messages and become compliant with the market requirements.

We recommend adopting the richest version pain.001 v9 to build on the latest format and realise the highest benefits.

What corporates need to know

Navigating the future of payments: five key ISO 20022 takeaways for corporate treasurers

25 July 2025: flow briefing

The world of payments is undergoing a fundamental transformation, and at the core of this evolution is ISO 20022 – the global messaging standard that modernises how financial data is exchanged.

It’s ISO 20022 time!

30 January 2025: flow briefing

To date, the ISO 20022 topic has centred around interbank messages. However, this is set to change: from November 2026, corporates will have to adopt XML-based payment messages in the ISO 20022 format. This flow briefing discusses the requirement of sending hybrid or fully structured address data and how corporates should prepare

Implementation details for your ISO 20022 migration

Payment address data requirements

ISO Changes on account information messages

ISO Testing options

Video tutorials

Important changes and information are compiled in these video tutorials. Click on the play button to watch specific sections or download the webinar presentation here.

FAQ for corporates

Show content of What is ISO 20022?

ISO 20022 offers a global framework for unified financial business communication. With a common set of syntaxes, message models benefit from pre-defined rules. Streamlining the communication process for corporates, the whole value chain including output data will be standardised. ISO 20022 is a messaging standard that creates a common language for payment data across the globe, enabling faster processing and improved reconciliation.

Show content of Why is the new standard being introduced?

Market infrastructures, such as Swift as well as clearing and settlement systems, have recognised that the existing legacy formats without structured data no longer meet current requirements for data quality, structure and efficiency in international payment transactions. Regulatory and political developments such as the G20 Roadmap for enhancing cross-border payments aim to make international payments cheaper, faster, more transparent and more inclusive. Particularly noteworthy here are the activities taking place under the umbrella of the CPMI (Committee on Payments and Market Infrastructures) of the Bank for International Settlements. Regulatory requirements to combat financial crime, such as anti-money laundering (AML) and combating the financing of terrorism (CFT) are also being tightened worldwide. ISO 20022, with its structured and detailed XML data format, provides the basis for improved monitoring and control of cash flow.

Show content of What does ISO look like compared to Swift MT Messages or other legacy formats?

ISO 20022 offers a far richer structure than MT or other legacy formats and includes additional/new data elements, which makes it difficult to compare these standards line by line. In general, ISO 20022 messages introduce a new message set-up, new elements, optionality, granularity, for some payment types an extended character set, for some payment types and channels character limitations, and new identification options.

Show content of When do companies need to adapt to ISO 20022?

This depends on the payment type and the standard applied. The Electronic Banking Internet Communication Standard (EBICS) has communicated end dates for legacy formats and enforces migration to ISO 20022. Overall, for international and urgent treasury payments, the postal address requirements in the interbank space coming into force by November 2026 enforce the practical migration for corporates from legacy formats to ISO 20022 by the same date. We have developed a country-by-country approach for your successful ISO 20022 migration. Depending on your current use of payment types and format, each migration might look different in timing and effort. Please follow closely Deutsche Bank communication on this topic on db.com/iso20022.

Show content of What are the benefits of ISO 20022 for companies?

The advantages of ISO 20022 are mirrored in the variety and structure of the information being processed end-to-end, i.e. from the payment initiation up to the account statement, which increases transparency and facilitates reconciliation. Country- and payment-type information, as well as the postal address information can now be sent to the financial institutions in dedicated data elements. This allows companies to achieve process automation and increase efficiency more easily. Applying the ISO 20022 standard will also facilitate compliance and risk checks such as AML and CFT as more data will be available. Details can also be taken from the flow briefing ‘It’s ISO 20022 time! What corporates need to know’ published on 30 January 2025.

Show content of What might be the most challenging client impact in the transition?

One of the most challenging steps within this migration will be the changes in internal and external processes and systems to provide structured information, e.g. for postal address or for regulatory reporting. Moreover, the implementation of a new format such as pain.001 means technical changes, testing with the banks and should be planned in terms of capacity and business operations.

Show content of What do I need to focus on during the ISO 20022 migration in my company?

Migrating to the ISO 20022 standard involves several steps and measures. These may vary depending on your specific requirements of your company, the heterogeneity of your technical landscape, and the complexity of your payment business. The following steps should be considered:

- Ensure address data is stored in a structured way in the respective address databases.

- Reach out to your enterprise resource planning (ERP) and treasury management system (TMS) providers, as well as to your financial institutions to ask for their timeline and support in the transition to structured information.

- Adjust processes and software to process structured address data in the ERP and TMS, or pre-saved templates in Deutsche Bank Cash Manager (including town name and country as minimum information).

- Prepare for the November 2026 deadline by migrating from legacy payment formats, such as MT101, German DK DTAZV, EDIFACT, IDOC, pain.001 v2 (if they are still in use).

- We recommend switching to the richest format, which is the pain.001 v9. However, you can also use pain.001 v3 but must ensure sending the address data and regulatory information in a structured way – at least the address town and county fields are recommended to avoid payment rejections in certain scenarios (e.g. international payments outside EU).

Show content of Will the legacy and existing format still be supported beyond November 2026?

Driven by the end date for unstructured postal address, companies need to prepare for migrating to the structured or hybrid address option by November 2026 at the latest. This date is the practical end date for legacy formats (e.g. MT101, German DK DTAZV, EDIFACT, IDOC) as unstructured address data provided after November 2026 will lead to payment rejections.

Show content of Where do I find ISO 20022 specifications (client usage guidelines)?

- EBICS multi-banking standard: specifications for pain and camt messages are available on the EBICS website.

- CGI-MP global standard: Specifications for new ISO messages can be found on MyStandards. Deutsche Bank will also make its own specifications available on Swift MyStandards (under Group “Deutsche Bank”) in line with the planned roadmap for payments. You can easily access these guidelines via Deutsche Bank Autobahn single sign-on.

Show content of Where do I find the usage guidelines and specifications for SCORE+ messages via the Swift FinPlus network?

Specifications are available on Swift’s website under this link.

To access this service, you must have a valid swift.com account. For more information, please refer to the Online Portal.

Show content of Glossary

| camt | cash management (ISO 20022 message type) |

| CBPR+ | Cross-Border Payments and Reporting Plus |

| CGI-MP | Common Global Implementation – Market Practice |

| DK | Deutsche Kreditwirtschaft |

| DTAZV | Deutscher Auslandszahlungsverkehr im Datenaustausch (local German format) |

| EBICS | Electronic Banking Internet Communication Standard (German multi-banking standard) |

| EPC | European Payments Council |

| ERP | Enterprise Resource Planning |

| ISO | International Organization for Standardization |

| MT | Message Type (Swift message type standard) |

| pain | payment initiation (ISO 20022 message type) |

| SEPA | Single Euro Payments Area |

| Swift | Society for Worldwide Interbank Financial Telecommunication |

| TMS | Treasury Management System |

| XML | Extensible Markup Language |