Deutsche Bank Research publishes insights on where investors see profits coming from in today’s post-pandemic, high inflation and rising interest rate environment

Many sources of company profits have recently been upended. Whereas managers used to rely on low interest rates and taxes, cheap labour, geopolitical certainty, strong M&A markets and other tailwinds, now, many of these trends are reversing.

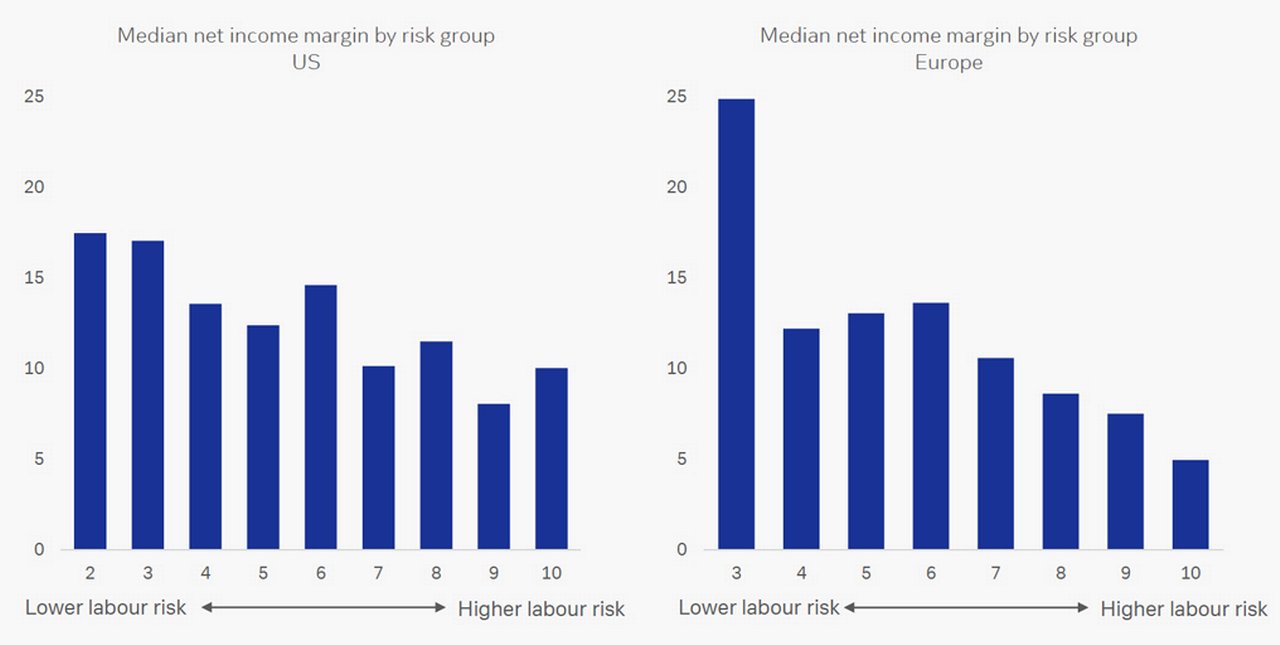

It is much harder to pass cost increases through to customers, benefits from global supply chains have waned as ‘just in time’ has evolved to ‘just in case’, and rather than acquiring revenues in costly acquisitions, companies that generate more sales from existing and neglected assets are in a better position to navigate today’s chopping economic waters. In addition, tight labour markets mean that companies with the highest labour risk have the lowest profit margins (see Figure 1).

Figure 1: Impact of labour risk on profit margins

Source: FactSet, MSCI, Deutsche Bank

These findings are just some of the insights from Deutsche Bank Research Analysts Luke Templeman, Galina Pozdnyakova and Olga Cotaga, who explain how companies can maintain and boost earnings under the new profit regime of the 2020s in their new research report, The C Suite: Past peak profits – How corporates can still command a premium available to Deutsche Bank Research subscribers published on 27 October 2022.

On 14 November, Templeman shared his views on the implications of rising costs, higher interest rates and political instability in Deutsche Bank Research’s latest edition of “Q&A with”, reproduced below:

1) What can corporates do if rising wages costs become the norm (incorporate the wages part and acknowledge the outsourcing point)

Companies used to cut labour costs by outsourcing. This is now difficult as the “wage arbitrage” between countries, particularly between the US and China, has shrunk. Meanwhile, geopolitical and supply chain risks are tilting companies towards some form of nearshoring or localisation.

“For investors, metrics such as ‘revenue per employee’ will become a greater focus”

The short-term response is for firms to either absorb higher costs, pass them on, or downsize their workforce. Clearly the former earns corporates more social and political points, yet layoff announcements and labour cost pressures are quickly dominating corporate news headlines. Did the post-covid hiring spree go too far? For investors, metrics such as ‘revenue per employee’ will become a greater focus. In the medium term, we may see corporate efforts to make goods and services less labour intensive and automated.

2) What does rising political instability mean for corporate profits?

There are two key issues here: investment policy and costs. For the former, political and geopolitical uncertainty is beginning to weigh on corporate investments as the range of outcomes of projects has broadened. Meanwhile, the increased frequency of ‘left tail’ events means greater unpredictability and more sunk costs.

For corporates exposed to reshoring initiatives, in sectors such as semiconductors, dependence on government incentives may become a source of risk if geopolitical tensions continue to rise. That may curb the ambitions of other business plans.

Political tensions are also likely to keep commodity prices more volatile for longer and increase the risk of shortages. As a result, hedging may become more expensive. Other cost increases will come from shipping, labour, and the consequences of potential expropriation. This will be especially relevant for firms with global supply chains where local changes can ripple across global operations.

3) How will higher interest rates impact corporate profits beyond simply raising borrowing costs? (capex vs. buybacks, less top-line growth M&A, asset turn)

Higher rates will curtail M&A activity that has boosted profits over the last decade. In its place, managers are being forced to focus on asset turnover – that is, generated more sales from existing assets. Higher rates also increase the discount rate which decreases the value of goodwill and other intangibles purchased during a decade of acquisitions. Any write-downs will impact profits.

Higher interest rates also change investment and financing decisions inside firms. This may result in longer-term or riskier projects being abandoned, foregoing potentially high cash inflows and other benefits.

The movement against profit-generating capex is also being highlighted by markets. Investors are pushing for shorter-term returns: so dividends and buybacks over long-term projects that require large investment.