February 2026

Deutsche Bank closes large project finance deal with SkyNRG to develop sustainable aviation fuel

The Deutsche Bank Project Finance team has signed and closed a significant non-recourse project financing to construct a greenfield sustainable aviation fuel (SAF) facility in the Netherlands-based Delfzijl chemical park.

Developed by SkyNRG, the Dutch biofuel SAF specialist, DSL-01 is the first greenfield SAF plant globally to secure project financing and will be the first European facility dedicated solely to SAF production, paving the way for future opportunities in this growing sector. Production is expected to start in mid-2028.

Dutch airline KLM has signed a fully cost-plus offtake agreement for 75% of the SAF volumes produced and has set itself a target of 10% SAF usage by 2030, 4% higher than the mandate set by the EU.

Integrating aviation into bio-based economy

Once fully operational the plant will produce 97,500 tonnes of SAF per annum, as well as 35,000 tonnes of sustainable biproducts, including bio-based propane, butane, and naphtha. It is expected that this will have an 80% lifecycle greenhouse gas reduction compared to fossil fuel, with a ramp up to circa 90% driven by increasing availability of Dutch renewable energy and reduced reliance on natural gas.

With ultimate shareholding from Macquarie Asset Management, KLM and the Dutch pension fund APG, SkyNRG grew from a vision to integrate aviation into the bio-based economy. SkyNRG’s mission is to lead the change in the energy transition by producing and supplying high-integrity SAF.

The company strives to establish sustainable aviation fuel as the new global standard, supporting aviation’s commitment to achieve net-zero emissions by 2050. SkyNRG builds SAF production capacity, manages supply and distribution, ensures sustainability through certified feedstocks, develops regional supply chains, and helps its corporate partners meet decarbonisation goals.

Overview of SAF market

According to the company’s Sustainable Aviation Fuel (SAF) Market Outlook published in June 2025,1 the SAF market is experiencing a period of rapid development. In 2024, supplied volumes doubled from the previous year. The start of the EU and UK SAF mandates in January 2025 marked a critical step, with projected global demand reaching approximately two million tonnes this year.

Looking ahead to 2030, demand could rise to over 15 million tonnes, with significant contributions from both mandated and voluntary commitments. An explanation of the various technologies available has been set out on the company website.2

“To capture longer-term dynamics, we’ve extended our analysis to reflect what is needed through 2050,” said SkyNRG CEO Maarten van Dijk. “Robust policy frameworks and targeted support for offtakers, technology developers, and infrastructure players are essential to keep SAF growth on track.”

This latest deal is a reminder that funding is also a key enabler.

Michael Volkermann, Global Head of Project Finance at Deutsche Bank, commented, “At Deutsche Bank, we’re financing the transition of the transport sector. HEFA*‑based SAF is the most scalable way to cut aviation emissions today – a true drop‑in fuel that delivers immediate climate impact.”

Plan of new SkyNRG SAF facility – source SkyNRG

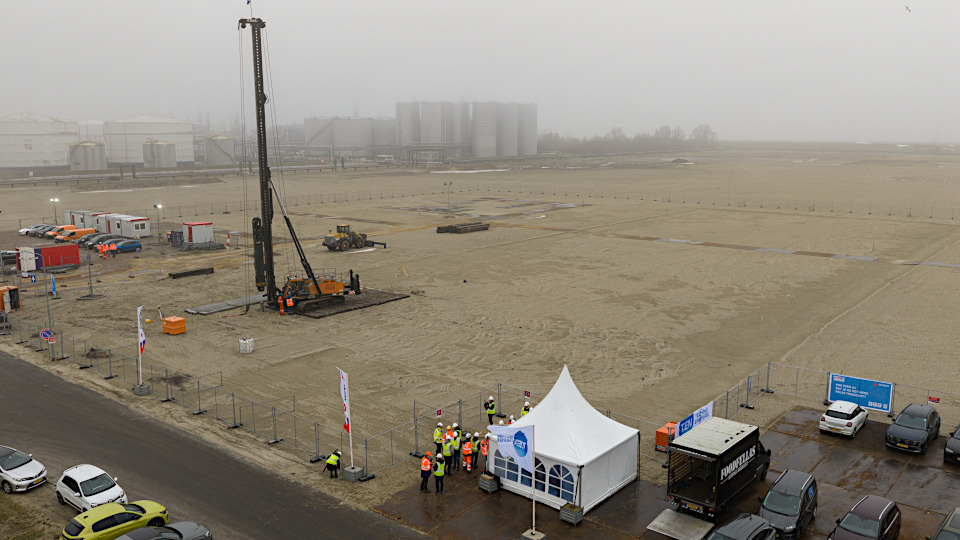

Site of new SAF facility in Delfzijl chemical park – source SkyNRG

*Hydrotreated esters and fatty acids

Sources

1 See SkyNRG & ICF release Sustainable Aviation Fuel Market Outlook 2025 at skynrg.com

2 See The basics of SAF Technology | The HEFA process at skynrg.com