September 2025

Deutsche Bank has unveiled further enhancements to dbX for FIs – its umbrella suite of correspondent banking tools launched in October 2024 – as the bank continues to respond to evolving client needs

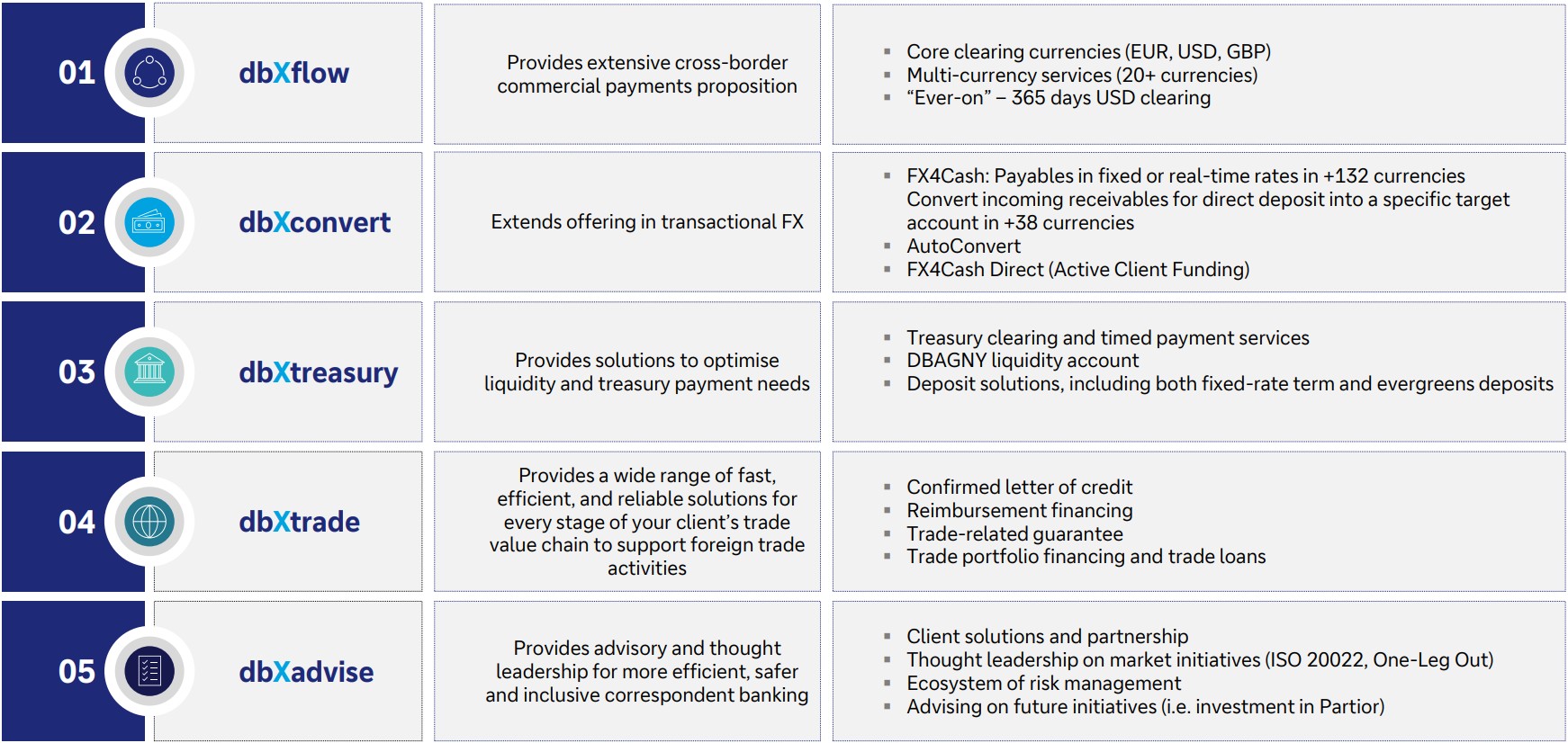

Deutsche Bank’s decision to combine its cash management and trade finance offerings for financial institution (FI) clients was complemented by the October 2024 launch of dbX – a gateway, comprising five core elements, which connects FI clients to the bank’s global network of cash and trade solutions (see Figure 1).

“Discussions with our clients reaffirmed our own conclusions that by integrating our services, our FI clients can, in turn, provide their underlying customers with comprehensive support for international transactions – from financing purchase orders to settling payments across borders,” said Patricia Sullivan, Global Head of Institutional Cash Management, Deutsche Bank. “Having now proven the approach works, we have continued to refine and expand it.”

“By integrating our services, our FI clients can, in turn, provide their underlying customers with comprehensive support for international transactions”

Figure 1: Components of dbX for FIs

A year on from launch, dbX for FIs is moving into its next phase, with recent upgrades demonstrating the platform’s continued evolution (for more information, see our video below):

- dbXflow. CHF clearing has been added to the existing core currency clearing capabilities – EUR, USD and GBP – with a 365 USD clearing solution set to launch shortly.

- dbXconvert. Auto-convert has been introduced, enabling automatic conversion of commercial cross-border payments into the local currency of the beneficiary.

- dbXtreasury. A new suite of deposit solutions has been added – including fixed-rate term and newly launched evergreen deposits – giving clients greater flexibility in a shifting rate environment and more competitive yield options.

- dbXtrade. FI Trade Loans have been introduced to support trade-related needs without requiring the disclosure of the underlying transaction.

- dbXadvise. Our Risk Management Ecosystem and Global Client Solutions teams have been integrated into this pillar, developing tailored solutions in collaboration with clients to address evolving requirements.

This evolution comes against a backdrop of mounting disruption in global trade and payments, with macroeconomic headwinds and geopolitical uncertainty heightening challenges for FIs, while innovative technologies, new entrants, and policy initiatives push providers to rethink their operating models. In this environment, the ability to configure solution sets as client needs evolve – and to respond quickly – is proving to be a key differentiator.

“Our clients need flexibility to adapt to a rapidly changing environment. That is why dbX is not a fixed set of products, but a continually evolving platform shaped by client demand,” said Sullivan. “We have further enhancements in development, with high-value payment initiation via API a top priority for early 2026, alongside ongoing exploration of blockchain.”

See our suite of dbX solutions for institutional clients here