July 2025

Deutsche Bank expands Escrow Direct functionality

Having launched a digital escrow platform in the form of Escrow Direct in September 2021, Deutsche Bank has expanded this service to cater for a wider range of client use cases, including commercial real estate (CRE).

Today’s ‘new normal’ in digital banking requires advanced online portals that simplify information access as well as gathering it. Mobile banking apps and online payment functions have long been commonplace in the retail space, but this is now gaining traction in corporate transaction banking.

Role of escrow

An essential part of multi-party deals, escrows are a counterparty risk mitigation tool, often serving as a condition precedent to a deal closing. As outlined in flow’s Escrow accounts explained’, this involves having a third party (the escrow agent) hold funds, securities, or other assets, pending the fulfillment of certain conditions to release or distribute the escrow.

Despite being used across a wide range of financial transactions – including mergers and acquisitions (M&As), real estate, insurance trusts, capital raising, project financing, litigation, and bankruptcy proceedings – the way escrow parties communicate and exchange information have required modernisation.

What is Escrow Direct?

Originally conceived as an M&A transaction solution, Deutsche Bank, in response to client feedback, adapted its platform to meet the needs of other escrow use cases – so that it can now be used to service commercial real estate (CRE) and other instances where payment facilitation is needed. For example, CRE clients, including loan servicers, would manually provide written instructions to send property revenue from their sub-accounts to their intended destinations. The weak link in this process is the reliance on an instruction verification process that requires call-backs and can slow down the movement of funds.

“Clients need a digital platform”

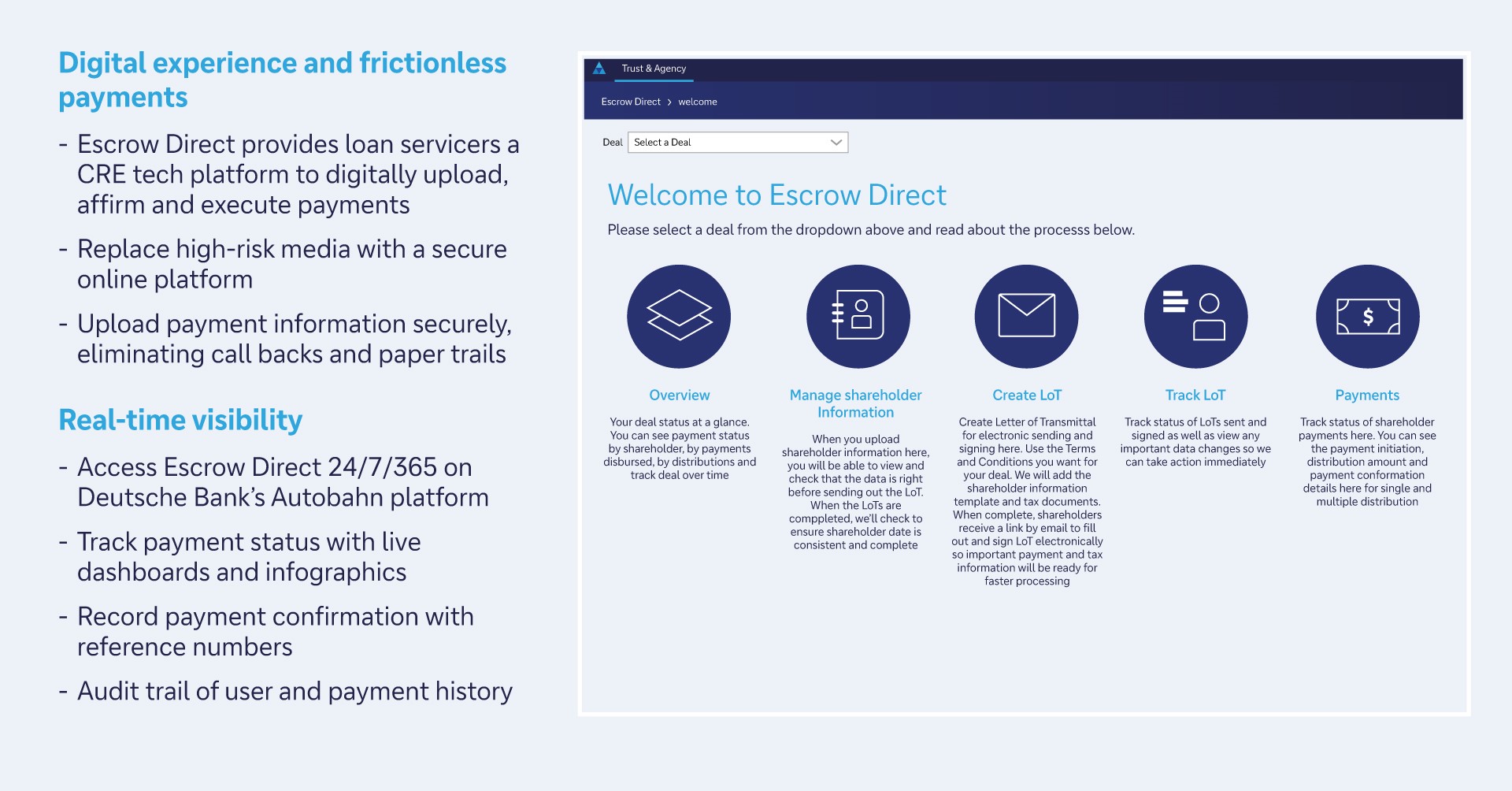

Escrow Direct is a digitised, centralised and simplified platform for buyers, sellers and lawyers, which allows for the management of payee information and facilitates fast-tracked payments to beneficiaries. It provides an automated solution, whereby clients can upload, validate, and authorise payment information in a secure environment. The system will validate the contents for accurate payment transmission, eliminating call-backs for a more streamlined experience. It also records payment confirmation reference numbers.

Figure 1: The Escrow Direct portal, now with CRE functionality

For examples of the CRE screens please see Figures 2 and 3 at the end of this news story

Digital transformation

“We have heard from our clients that they need a digital platform that can service more than just M&As,” explained Kisha Holder, Head of Escrow and Specialised Agency Services, Americas Deutsche Bank. “And with demand for digitalisation on the rise, we’ve made enhancements to Escrow Direct that now make a digital option available to other escrow use cases – creating a versatile, one-stop platform for escrow services.”

She added that the key to the upgrade was finding additional ways to accelerate processes through electronic access while preserving the bank’s trusted role at the centre of escrow agreements.

Deutsche Bank has worked closely with one of its clients to adapt the platform – ensuring it was made more relevant to their industry sector’s specific needs.

Hanover Street Capital and the CRE experience

This collaboration is the partnership with Hanover Street Capital (Hanover), which provides a dedicated service to Deutsche Bank across all CRE property types ranging from senior mortgages to subordinate debt.

Established in 2012, Hanover provides its services across the lifecycle of commercial real estate via a dedicated platform. This delivers integrated solutions in support of the end-to-end functions of Deutsche Bank’s commercial and multi-family real estate financing business in the US.

At the outset, it was clear that several changes would be necessary to improve both the functionality and user experience of Escrow Direct – and make the portal more relevant for Hanover’s business.

A successful partnership

Deutsche Bank’s escrow team, within its Corporate Trust team, reached out to Hanover to work with the bank as one of the initial users of the online banking tool.

“The mutual effort to nurture and ensure the success of the platform has been phenomenal”

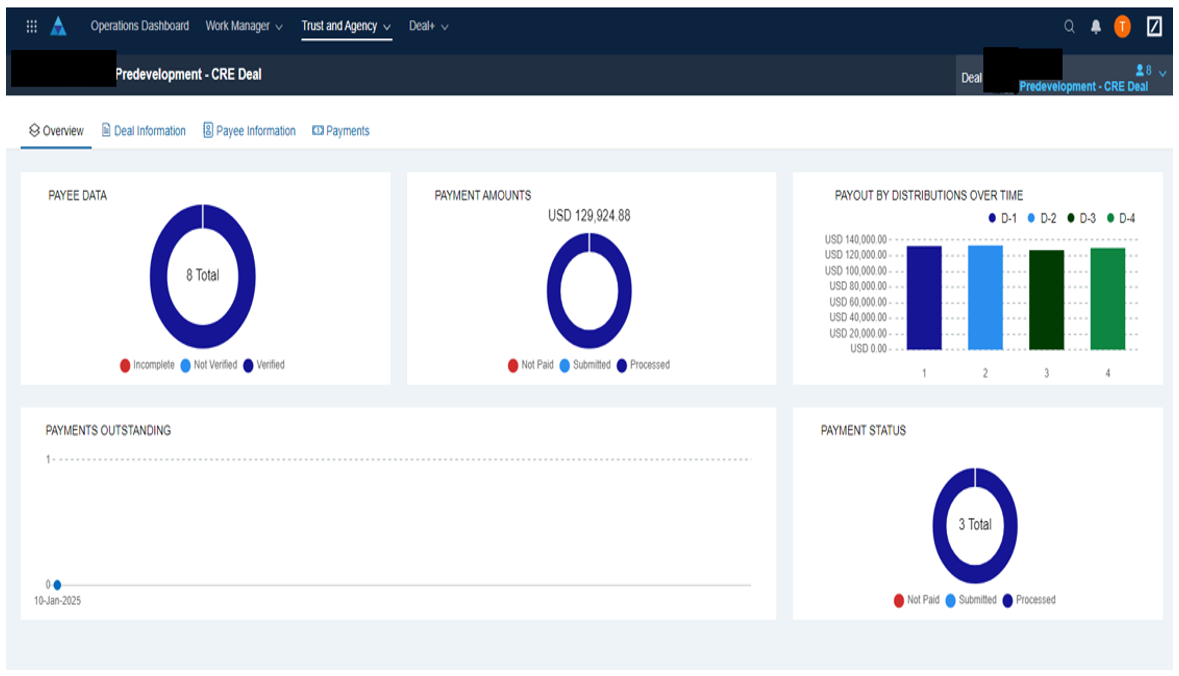

“We identified areas where data flow and accessibility needed to be more streamlined, and some processes required automation to reduce manual input,” said Stephanie Bracero, Head of Loan Administration, Hanover Street Capital. “These adjustments were necessary to enhance operational efficiency and ensure that we could effectively track and manage information in real time.”

Improvements included the introduction of email notifications for payment flow changes requiring action – replacing the slower, traditional process of logging in periodically to check.

Bracero explained that to ensure a successful transition and partnership, a dedicated contact person was designated by both parties. This involves a member of the Hanover loan administration team partnering with a member of Deutsche Bank’s escrow team to “guarantee a smooth implementation of the accounts to the Escrow Direct platform”.

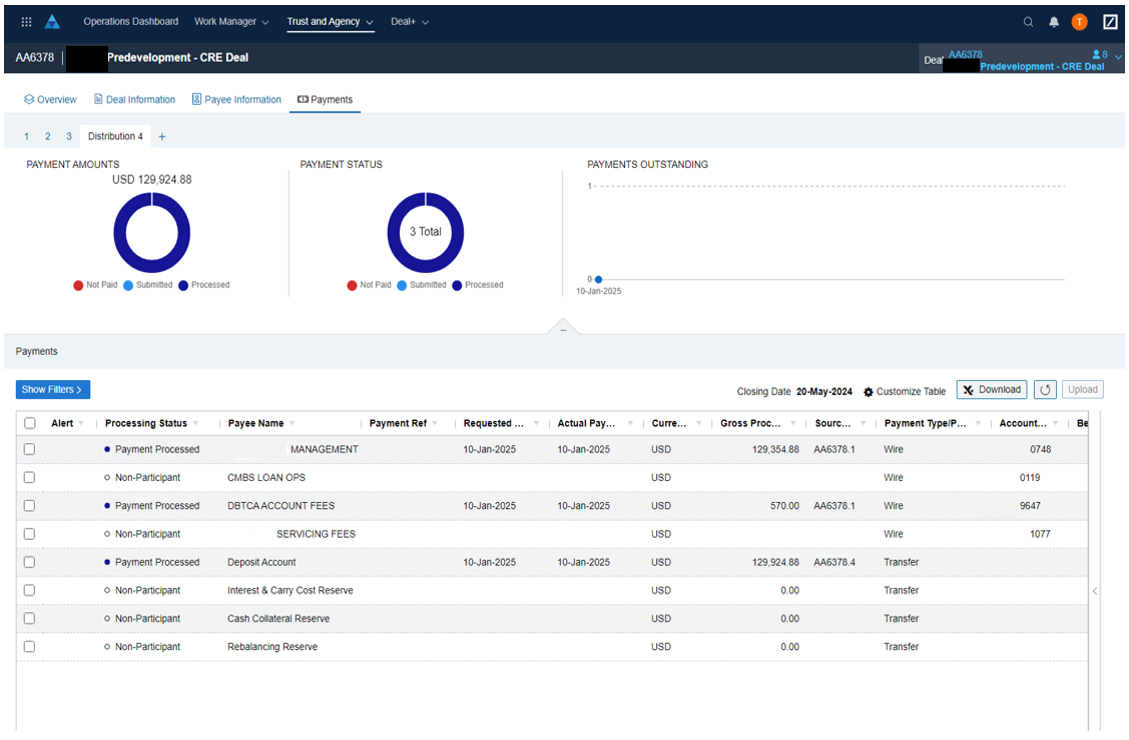

A key efficiency is the non-callback feature, which enables Hanover to verify transactions directly through the platform rather than manually. The result is faster processing and more streamlined transactions.

“There may still be additional tweaks or new features needed as we continue to work with the new system, but we are confident that the Deutsche Bank team will continue to deliver,” said Bracero. She highlights the professionalism that ensures the portal is updated regularly “with relevant modifications that align with our evolving business needs”.

Concluding, Bracero reflects, “Despite the relatively brief period of use, the mutual effort to nurture and ensure the success of the platform has been phenomenal.”

Figure 2: CRE transaction overview dashboard

Figure 3: CRE payment dashboard

For further information about Escrow Direct, visit our Corporate Trust solutions page here.

Sources for Figures 1, 2 and 3 © Deutsche Bank