October 2024

Deutsche Bank’s Bangladesh office marks second anniversary with cash management innovation

Two years ago, Deutsche Bank opened a representative office in Dhaka, Bangladesh, with the country’s status as one of Asia’s fastest-growing economies bringing significant opportunities to support the German/Bangladesh trade corridors.

A remarkable growth journey

Deutsche Bank has since expanded its approach to connect the Bangladeshi market to the rest of the world through its global network and partnership with international financial institutions, as part of its wider Global Hausbank strategy. It has done so through its suite of trade finance and lending products while expanding its offering to include cash management solutions going forward.

“We have managed to grow our books in full compliance with local and international regulation”

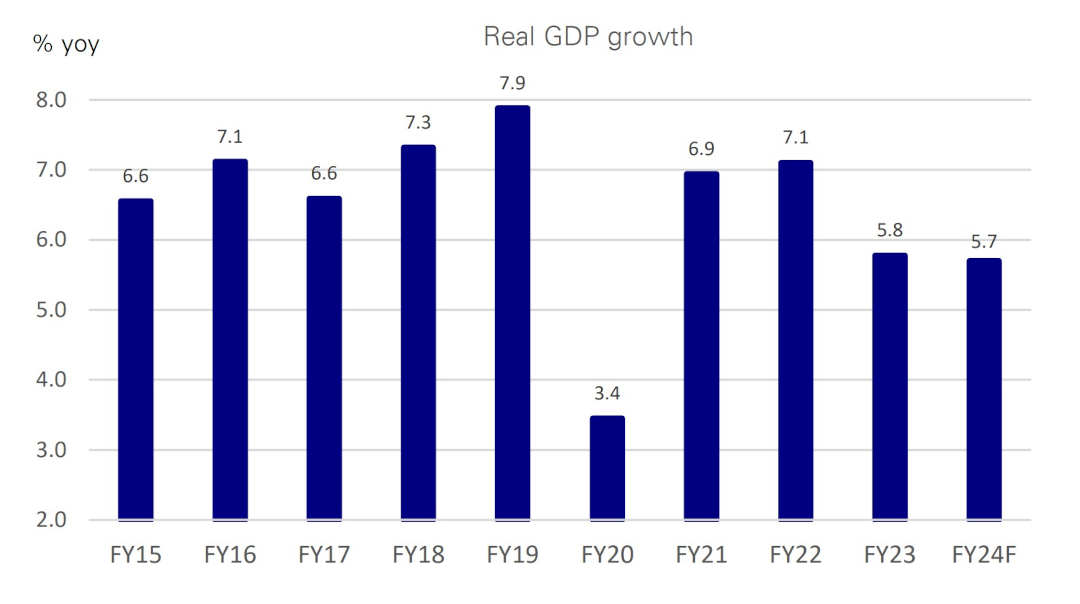

In 2023, Bangladesh’s gross domestic product (GDP) stood at around US$437bn, positioning it among the top 40 largest global economies. Backed by a GDP growth rate of 5.8% that year (see Figure 1), Bangladesh is not only showing steady progress but also outpacing the emerging and developing Asia peer group by 0.5% in 2023.1 This trajectory is expected to continue over the coming years supported by the country’s strength in its manufacturing, services and agriculture sectors.2

However, noted India Chief Economist Kaushik Das in his Asia Economic Notes Special report: Bangladesh - In search of a new economic model (26 June), given that Bangladesh will be transitioning from the United Nations’ Least Developed Country (LDC) classification in 2026, with the accompanying loss of preferential market access, the country “will most likely face tariff hikes in most of its major export destinations”. Das points out that its current dependence on the ready-made garments industry (RMG), at 85% of total exports presents a risk to growth. He calls for a new economic model “to sustain its previously achieved high growth trajectory” via policy reforms.

Figure 1: Real GDP growth has moderated steadily and remains below the 6% mark

Source : CEIC and Deutsche Bank

Business expansion

The country’s strong economic fundamentals have stimulated growth in demand for corporate banking services from Deutsche Bank that provide support for the country as it seeks to diversify its economy and moves out of LDC status. “Since the launch of the representative office, we were able to intensify our existing relationships and increase our revenues by more than 100% year on year, while being mindful of the existing risk environment,” said Syed Naushad Zaman, Chief Representative Officer, Deutsche Bank. “Despite various external challenges, we have managed to grow our books in full compliance with local and international regulation”.

The bank has been offering confirmation and discounting solutions for letters of credits (LCs) issued by Bangladesh-based banks – supporting clients in facilitating trade transactions and mitigating risks. LCs have had longer tenors and larger ticket sizes and trade finance asset distribution has increased by a factor of eight, said Zaman. In addition to its German-Bangladesh trade finance, the bank processed LCs originated from Bangladesh in global Deutsche Bank locations, such as France, India, Italy, Singapore.

Deutsche Bank now plans to expand its offering to include cash management products for financial institutions in Bangladesh to support the liquidity management and payments clearing needs of local banks in various currencies.

Navigating political risk headwinds

Despite the positive outlook for Bangladesh, the underlying operating environment on-the-ground has not always been as favourable. For example, in July 2024 the country experienced significant domestic widespread unrest, with protests triggered by a controversial employment quota system leading to unrest. On 16 August 2024 in his follow up report, Bangladesh: tough times ahead, Das commented, “An interim government has been put in place since the start of the political crisis, whose main objective is to restore law and order in the country and to ensure a smooth political transition in the period ahead. Fresh elections are likely to be held in the period ahead, but it remains uncertain how long it will take for normalcy to be restored before elections can be held.”

He continued, “We remain hopeful that Bangladesh will be able to restore normalcy soon and rise up to deal with the economic challenges in a resilient manner, as it has managed in earlier periods of crisis.” While other central banks such as the Federal Reserve, The European Central Bank and the People’s Bank of China are loosening their monetary policies, he anticipates interest rate hikes from the Central Bank of Bangladesh “to rein in inflation and prevent capital outflows”.

“Far from turning our back on Bangladesh during the challenging period, we have instead looked to strengthen our relationships – ensuring Deutsche Bank remains a meaningful and strategic partner for banks during the good times and the bad,” explained Tsvetanka Nankova, Deutsche Bank’s Global Head of Sales Institutional Cash and Trade Finance. “Our objective is to partner with financial institutions that have strong fundamentals and we are committed to managing non-financial crime risk in alignment with our risk appetite.”

The bank’s long-term commitment to Bangladesh is demonstrated by its ongoing support with banking transformation initiatives – notably those associated with effectively combatting financial crimes. To turn the tide of de-risking and withdrawal from challenging geographies, the bank is providing education and working closely with the regulators on the continuous enhancement of regulatory frameworks. Getting this right in Bangladesh is an important step towards a prosperous future.

Note, the header image of this news story depicts the lush green tea gardens of Darjeeling Tila, in Srimongol Sylhet, Bangladesh, in reflection of the region’s growth potential

Deutsche Bank Research reports referenced

Asia Economic Notes Special report: Bangladesh - In search of a new economic model by Kaushik Das, Deutsche Bank Research 26 June 2024

Asia Economic Notes: Bangladesh: Tough times ahead, by Kaushik Das, Deutsche Bank Research, 16 August 2024

(full reports are available at www.dbresearch.com to subscribers)