February 2025

Deutsche Bank secures 25 No 1 trade finance rankings in Euromoney’s new market data-based awards for 2025, as global trade growth reaches new high

While the latest announcements and developments on tariffs might suggest that multilateral transactions are under threat trade continues to flourish, despite the noise around tariffs and trade wars. flow assesses the momentum of global trade growth as a backdrop to the 2025 Euromoney Trade Finance Survey results, based on 2024 analysis.

Continued global trade growth

According to the UN Trade & Development (UNCTAD) data, global trade is “set to reach a new high with opportunities and challenges for developing economies in 2025”.1 This volume comprised almost US$33trn in 2024, with a US$1trn increase largely driven by a 7% rise in services trade. On 3 February the WTO provided further insights into how services trade was powering ongoing growth.2

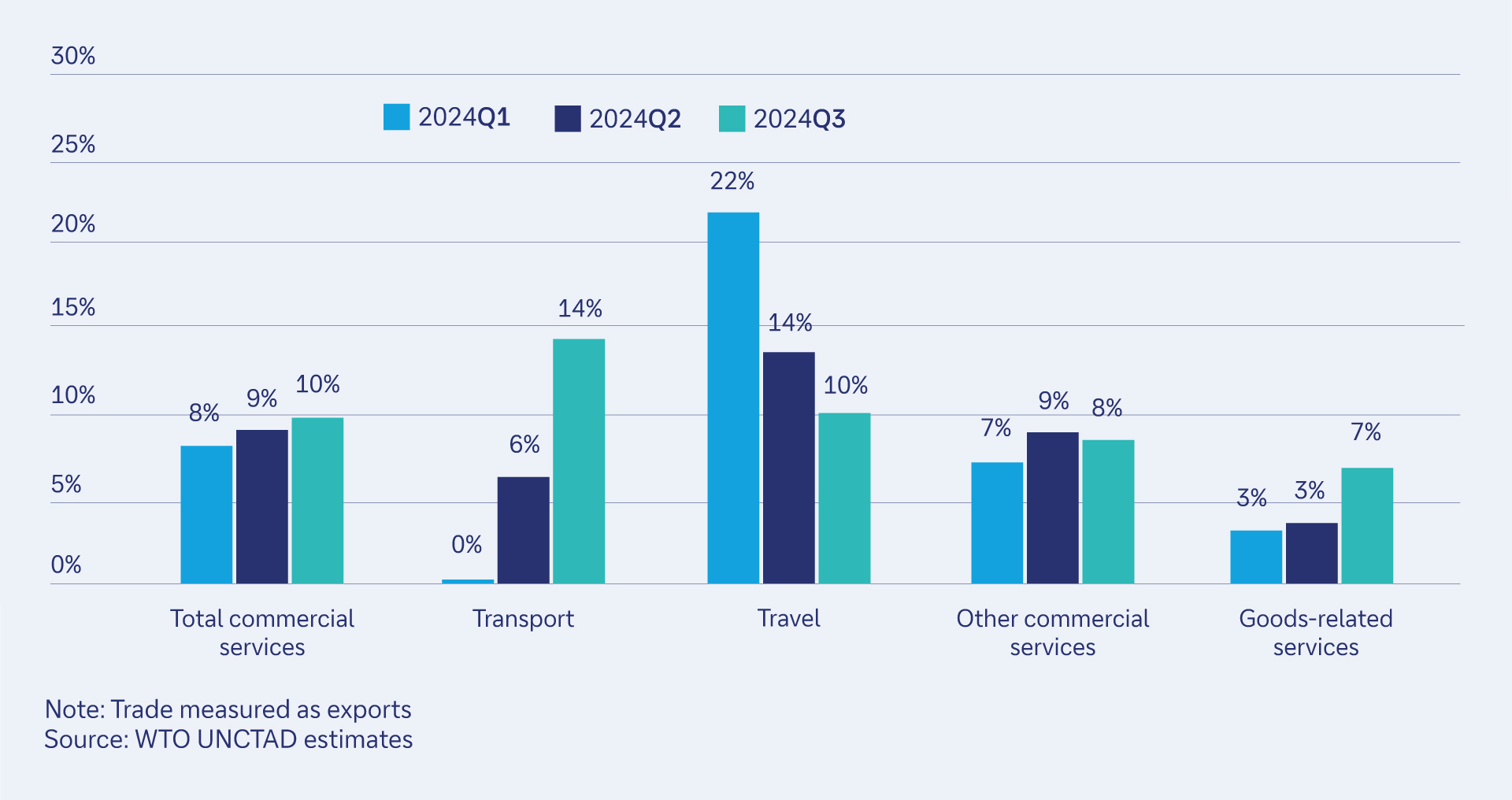

Figure 1: Commercial services trade by broad sector Q1 to Q3 2024 percentage change year-on-year

Services are the “bright spot of trade” noted the WTO, with growth of 9% year-on-year in the first three quarters of 2024 This is in sharp contrast with goods trade, which was up by only 2% over the same period.

Compared with the same time a year ago when headwinds such as high inflation and central banks keeping interest rates high in a battle to reduce it, there is a real prospect of “stable global growth” and this, says UNCTAD, together with the easing of inflation, “creates a window for developing economies to strengthen their trade position amid rising geopolitical uncertainties”.

The past year has also demonstrated how geopolitical considerations continue to play a central role in the supply chain shifts, reflects Atul Jain, Global Co-Head of Trade Finance & Lending at Deutsche Bank. “Governments and businesses are increasingly focusing on building resilient supply chains, fostering new trade partnerships to ensure stability and to meet evolving global demands,” he says. “The focus on energy security, defence, healthcare, and semiconductors highlights the prioritisation of national interests.”

Asia epicentre

Another key driver has been the ramp-up in intra-regional trade with the epicentre of global trade shifting to Asia, according to a McKinsey report in September 2024.3 This noted “trade connections within Asia are intensifying economic interdependence” and that “the region accounts for more than half of global trade, middle-class households, manufacturing value added, and GDP growth”. This offers opportunities, concluded the report, “for economies that can further integrate into Asian and global value chains”.

“Asian trade is deeply interconnected, with countries leveraging one another's strengths”

“The future of trade is in Asia,” agrees Deutsche Bank’s Jain. “Asian trade is deeply interconnected, with countries leveraging one another's strengths in sectors such as semiconductors, LNG, and manufacturing. This mutual reliance fosters an ecosystem of collaboration and efficiency, which has been key to driving growth across the region,” he adds.

Drivers of award results

Aligned with Deutsche Bank’s Global Hausbank strategy, the focus on supporting the bank’s global corporate clients in emerging and frontier markets has clearly had an impact, reflected in the 2025 Euromoney Trade Finance Survey global award as the ‘World’s Best Trade Finance Bank for Large Corporates’ (see below).

Jain explains, “In addition, we have been expanding our project finance capabilities to support infrastructure development and energy transition, embarking on new partnerships with multilaterals and development finance institutions, targeting new high-growth client segments in strategic sectors”.

Euromoney Trade Finance Survey – a key barometer

For almost 30 years, Euromoney’s trade finance survey has provided a vital benchmarking exercise of the world’s banks active in trade finance, offering useful insights into the needs of clients and their perceptions of the banks they work with. In Q4 of each year, via a detailed online questionnaire, clients across the world vote for the financial institutions they consider to be the best providers in their markets and how those firms perform across a range of categories.

In 2024, the questionnaire was restructured to yield more conclusive market-based data. More than 13,000 corporate clients ranked and scored the industry’s leading banks to inform more than 260 rankings across five regions and 50 countries. In addition, the awards were restructured to include a new ‘Best Trade Finance Bank’ award that focuses on qualitative instead of quantitative aspects with minimum thresholds in place for a bank to qualify.

Respondents may select up to five trade finance providers for each geography where they operate in. Providers are evaluated based on 24 quality criteria, with overall scores calculated as the average across four key categories: products, services, people, and technology.

Deutsche Bank’s Trade Finance and Lending team secured 25 No 1 trade finance rankings and the coveted title of ‘World’ Best Trade Finance Bank for Large Corporates’ – one of six awards at a global level.

“We firmly believe our product breadth, bespoke solutioning, exceptional service, and global network – in combination – deliver truly differentiated value to global corporates,” says Jain. “This client-led recognition resoundingly affirms the same, for which we are deeply grateful”.

Deutsche Bank results

Overall no.1 awards:

25 times voted no.1 for Trade Finance

Global award:

World’s Best Trade Finance Bank for Large Corporates

National awards:

Best Trade Finance Bank/Best Bank for Trade Finance Products, Technology and Client Service in China

Best Trade Finance Bank/Best Bank for Trade Finance Products, Technology and Client Service in Malaysia

Best Trade Finance Bank/Best Bank for Trade Finance Products, Technology and Client Service in Pakistan

Best Trade Finance Bank/Best Bank for Trade Finance Technology and Client Service in the Philippines

Best Trade Finance Bank/Best Bank for Trade Finance Client Service in Taiwan

Best Bank for Trade Finance Client Service in Saudi Arabia

Best Bank for Trade Finance Products in Singapore

Best Bank for Trade Finance Products in Germany

Best Bank for Trade Finance Products in Switzerland

Best Bank for Trade Finance Products in the United Kingdom

Regional:

Best Bank for Documentary Collections in the Middle East

Best Bank for Letters of credit/Guarantees in the Middle East

Atul Jain

Co-Head of Trade Finance and Lending, Deutsche Bank