31 March 2022

The annual Trade Finance readership survey conducted by Euromoney magazine provides an important market barometer of bank trade finance activity and borrower satisfaction – being survey-based, it ranks financial service providers across a selection of market leader and service categories.

Not for the first time, Euromoney’s 2022 survey is published as another ‘Black Swan’ disrupts global trade. Having noted in February 2021 that “a year is a very long time in trade finance”, as the world grappled with Covid-19, few could have foreseen that just 12 months later the Russia/Ukraine crisis would rearrange global trade all over again.

To paraphrase The Economist, globalisation has been dealt its third big blow in less than a decade (following US/China trade wars and the Covid-19 pandemic),1 and again the risk dependency on one exporter for critical supplies has been highlighted. Within the EU’s energy imports, Russia accounts for 40% of natural gas imports and 20% of oil imports, according to Deutsche Bank Research.2

So, trade is at another inflection point. While the world needs what the World Trade Organization calls a more open, inclusive and predictable trade environment to “promote diversification and contribute to economic resilience”,3 geopolitics and Covid-19-related supply chain shocks having provoked retrenchment into near-sourcing and protectionism.

Yet it’s not only geopolitics that is changing trade flows. As economies transition towards net zero emissions pledge deadlines, decarbonisation is shaping the demand driver for several hard commodities. “Transition metals” such as aluminium, copper (renewable energy infrastructure), and lithium (batteries) are among the examples.4

As for energy transition – managing this in a way that does not further disrupt already fragile supply chains and trigger inflation-inducing price rises will not be easy and requires determined exploration and innovation – plus finance. “There are technologies vital to energy transitions that can be a match for the industry’s capabilities, such as carbon capture, low-carbon hydrogen, biofuels and offshore wind,” notes the International Energy Agency in its analysis Oil 2021.5

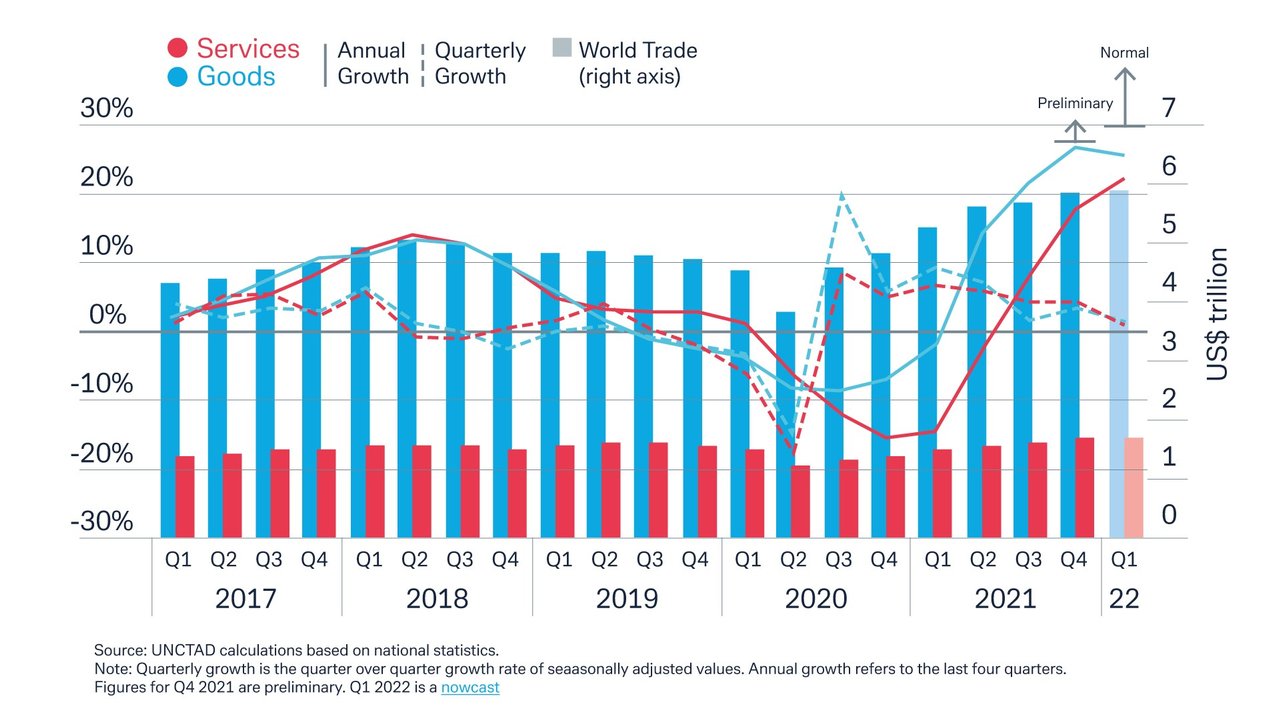

Growth in world trade 2021

While the overall market trends remain challenging, data shows that global trade is standing strong. In 2021, volumes bounced back from the pandemic’s impact, with the United Nations Conference on Trade and Development (UNCTAD) recording an all-time high of US$28.5trn, an increase of almost 13% on pre-pandemic levels. UNCTAD’s Global Trade Update (17 February 20226) notes that while most global trade growth took hold during the first half of 2021, momentum carried over into the second half when after a relatively slow third quarter, trade growth picked up again in Q4 2021, with the value of global trade increasing by about 3% relative to Q3 2021 (see Figure 1)

Figure 1: Trade’s 2021 growth spurt

Source: UNCTAD calculations based on national statistics.

Note: Quarterly growth is the quarter over quarter growth rate of seasonally adjusted values. Annual growth refers to the last four quarters.

Figures for Q4 2021 are preliminary. Q1 2022 is a nowcast

Trade in goods and trade in services followed similar patterns during 2021, with stronger increases during the first half of the year. The positive trend continued for both goods and services in Q3 2021 and accelerated in Q4 2021. With the report published before the Russia/Ukraine war started, already the forecast for 2022 was for slower trade growth with trade values remaining broadly similar to Q4 2021 levels. What effect the crisis has on this year’s performance will become clearer when the 2022 report appears in early 2023.

Encouraging developments in Asia

The region continues to provide a beacon of trade growth, helped by its cooperation agreements and helpful demographics – for example India, the world’s second most populated country, has an average population age of 28 years.

On 1 January 2022, the Regional Comprehensive Economic Partnership (RCEP) entered into force. This trade agreement facilitates trade among many of the East Asian and Pacific economies, and is expected to significantly increase trade between members, including by diverting business from non-member countries. Signed on 15 November 2020 at the 37th ASEAN Summit hosted by Vietnam, RCEP is, according to World Bank data, set to cover 2.3 billion people (around 30% of the world’s population) contribute around US$25.8trn (around 30%) of global GDP and account for US$12.7trn of global trade in goods and services.7

The ASEAN group of countries, as explained in the flow ASEAN dossier, have successfully integrated economic and financial markets, eliminated most intra-ASEAN tariffs and supported its SMEs with their participation in global value chains. This all helps with building resilience to economic shocks such as Covid-19 – and more recently – escalating oil prices and inflation threats.

Trade finance gap widens

With around 80% to 90% of world trade reliant on trade finance (trade credit and insurance/guarantees),8 mostly of a short-term nature, it is not surprising that the revival of trade volumes has, in turn, driven up demand for trade finance. Worryingly, not all demand can be met – the Asian Development Bank puts the gap at US$1.7trn – against US$1.5trn two years ago.9

This year’s Trade Finance readership survey by Euromoney took place against this challenging backdrop. It welcomed more than 10,700 respondents confirming just how critical Trade Finance remains for bank customers worldwide. Deutsche Bank received a total of 17 No.1 positions across Market Leader and Best Service categories (see detailed results below).

“I am delighted that we have received such a strong endorsement for our services as Global Hausbank from our clients across many countries and regions,” said Stefan Hoops, Deutsche Bank’s acting Global Head of Trade Finance & Lending and Head of the Corporate Bank. He continued, “During such times of market volatility and geopolitical uncertainty, trade finance is what keeps the world economy running. It is a privilege to support our clients in facilitating their international business activities.”

Detailed results overview

Category: Market Leader

Best Trade Finance Provider: by region

Western Europe: No.1 (5th time running)

Best Trade Finance Provider: by country

EMEA

Germany: No.1 (10th time running)

Netherlands: No.1 (2nd time running)

Asia Pacific

South Korea No.1 (2nd time running)

Americas

United States of America No.1 (2nd time running)

Category: Best Service

No.1 Best Service Provider All Services: Middle East

No.1 Best Service Provider All Services: North America

No.1 Best Service Provider All Services: China

No.1 Best Service Provider All Services: Hong Kong SAR

No.1 Best Service Provider All Services: Netherlands

No.1 Best Service Provider All Services: Philippines

No.1 Best Service Provider All Services: Saudi Arabia

No.1 Best Service Provider All Services: Spain

No.1 Best Service Provider All Services: Sri Lanka

No.1 Best Service Provider All Services: Thailand

No.1 Best Service Provider All Services: United Arab Emirates

No.1 Best Service Provider All Services: United States of America

Sources

1 See https://econ.st/37YI8SK at economist.com

2 See Ukraine on the brink at flow.db.com

3 See https://bit.ly/3iHRTXx at wto.org

4 See Transition metals: in the fast lane? at flow.db.com

5 See https://bit.ly/3uxZ2PX at iea.org

6 See https://bit.ly/3IHTBCY at unctad.org

7 See https://bit.ly/3No5GRr at rcepsec.org

8 See https://bit.ly/3NuE8K3 at wto.org

9 See https://bit.ly/3NrSIlF at adb.org