January 2025

Evonik and Deutsche Bank partner to issue electronic securities via Clearstream’s digital platform

Deutsche Bank Trust and Agency Services (TAS) has supported one of the first corporate bond issuances that took place via Clearstream’s digital issuance and post-trade platform D7. Clearstream is the post-trade services provider for Deutsche Börse Group. Acting as both fiscal and paying agent, the TAS multi-disciplinary team supported Evonik Industries AG, a publicly listed specialty chemicals company based in Germany, with the placement of a €500m five-year green senior bond on D7.

The transaction was completed in January 2025 and expanded upon new opportunities brought about by the German Electronic Securities Act (‘eWpG’) passed in July 2021. The law permits the issuance of certain securities such as conventional and convertible bonds, profit-participation certificates, warrants and investment certificates to be issued in a purely electronic format. Previously, financial instruments deemed securities under civil law had to be issued in the form of a physical certificate. On its website, Germany’s Federal Financial Supervisory Authority, or BaFin, notes that, “the entry of the issue in a database is now replacing this physical global note used in the past.”1

Clearstream, introduced D7 in October 2021 in the context of the new Act. The digital platform has handled over 600,000 electronic issuances totalling over €20bn so far. The majority of these issuances were structured products like certificates issued by banks. The Evonik deal was the first corporate bond benchmark issuance from an issuer outside of Deutsche Börse Group, and only the second to be administered by an external issuing and paying agent; in October 2023, Deutsche Börse itself issued €3bn worth of corporate bonds via its digital platform.2

“This transaction illustrates the growing relevance of a digital securities services ecosystem”

Ludger Nahen, Head of Capital Markets at Evonik states that, “this transaction illustrates the growing relevance of a digital securities services ecosystem which will contribute towards increasing the efficiency of capital market funding. Deutsche Bank managed the legal and technical preparations that were needed to enable this digital issuance very well.”

Looking ahead, Soeren Lindequist, Trust and Agency Services, Deutsche Bank, believes that “the practical implementation of eWpG in the corporate space will reduce processing times of securities issuance and risks related to physical deliveries and manual handling of transaction documents for our corporate clients. The transaction also demonstrates Deutsche Bank’s commitment to collaboration on innovation and dedication to client solutions”.

Jens Hachmeister, Head of Issuer Services & New Digital Markets at Clearstream, adds: “Digital issuance represents a significant leap forward in the efficiency and security of securities transactions. We are thrilled to welcome Evonik and Deutsche Bank on our digital D7 platform as one of the first corporate issuers. Our clients’ commitment and trust highlight the transformative potential of scalable digital solutions for the future of digital financial markets.”

How the digital issuance process works

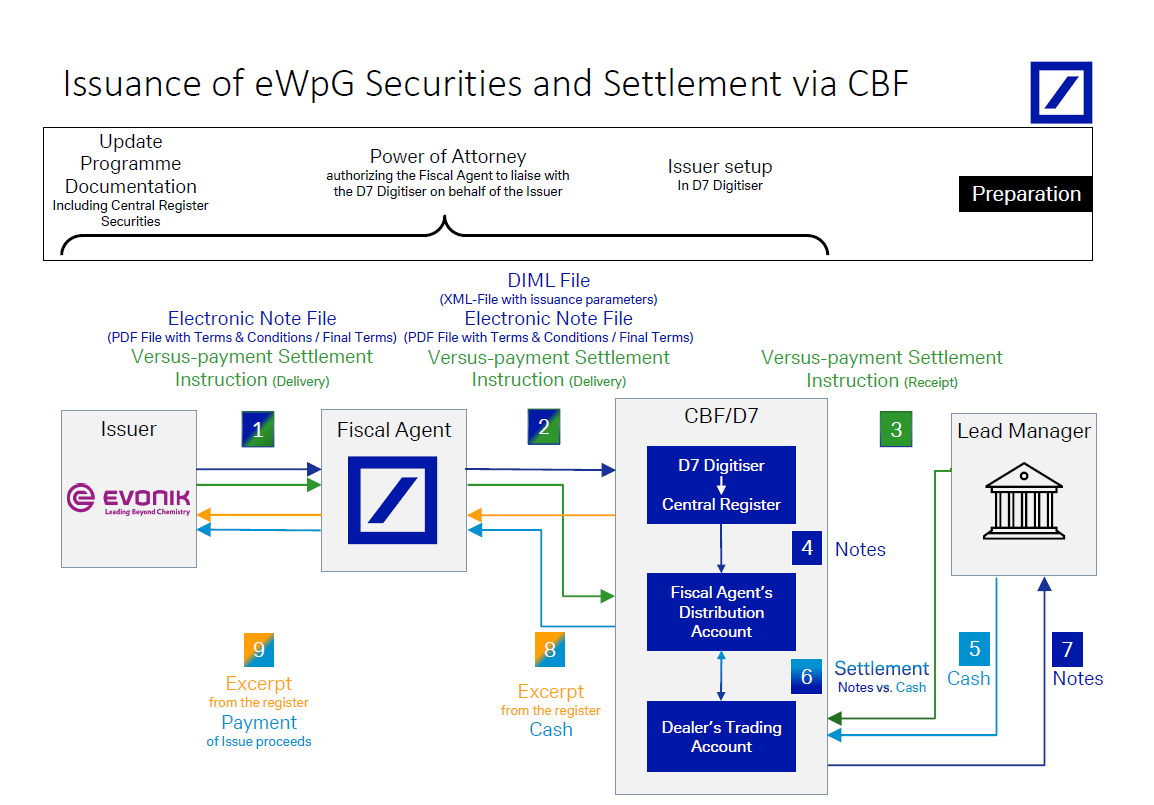

As part of the transaction, Deutsche Bank TAS acted as fiscal agent tasked with creating an XML file that included the issuance parameters based on the electronic note file, consisting of the pre-agreed terms and conditions sheet and uploading both, the XML file and the electronic note file (see Figure 1/step 2). On the issue date, the bank managed the delivery-versus-payment settlement instruction to Clearstream’s digital registry D7 and ensured that Evonik received the excerpt from the digital register (see Figure 1/step 9).

In the ‘old’ model based on physical documents, the issuer had to create a physical global note and courier it to the fiscal agent. The agent manually authenticated the note, uploaded the technical details in its systems, and delivered the global note to Clearstream. The settlement provider again had to type the details into its settlement system and take the physical global note into safe custody. Copies of the global note were delivered to the issuer for the proof of issuance. This process could take up to two business days. Now this is replaced by an end-to-end digital process.

Finally, over the lifecycle of the bond, TAS acts as paying agent to ensure cash flows related to such debt instruments (such as interest and redemption payments) between Evonik, as issuer, and the investors are made. Presently, D7 focuses on the domestic market in Germany, but there are plans to extend the reach to the International Central Securities Depository (ICSD) to allow for the digital issuance of Eurobonds.

Figure 1: Issuance of eWpG Securities and Settlement via Clearstream Banking AG, Frankfurt (CBF)

Source: Deutsche Bank

Outlook: Internationalisation and Distributed Ledger Technology (DLT)

“This transaction marks a significant milestone as we have now put in place processes to support issuers to keep pace with the digital asset evolution in the financial services industry,” says Miriam Keeler, Business Head, Trust and Agency Services, Deutsche Bank.

There are two angles to this evolution: first, the tokenisation of securities and second, the drive towards shorter settlement cycles. Indeed, the eWpG was introduced on the back of the German federal government’s distributed ledger technology (DLT) strategy. As such, the law not only removes the requirement for a physical certificate but the electronic registry can also be operated based on DLT systems (‘crypto securities register’), as BaFin explains.3

So far, the EU Regulation on Central Securities Depositories (CSDR) precludes the trading of crypto securities on European stock exchanges. Yet, pilot transactions are being conducted to understand technical requirements. Clearstream, for example, has complemented its D7 platform with DLT-based architecture to enable frictionless tokenisation of securities. The solution was launched as part of the blockchain trials conducted by the European Central Bank (ECB) in 2024.4 According to Clearstream, these trials demonstrated, the “D7 DLT ability to issue securities on blockchain, handling both securities and central bank digital currency, with a vision to further scale these capabilities in the future”.5

The transaction can also be understood as part of the general move towards shorter settlement cycles in Europe. In November 2024, the European Securities and Markets Authorities (ESMA) recommended 11 October 2027 as the target date to transition towards next business day settlement (‘T+1’). The aim will be to increase the efficiency and resilience of post-trade processes which, in turn, will induce greater settlement efficiency in the EU, and better global market integration.6

Sources

1 See bafin.de

2 See linklaters.com

3 See bafin.de

4 See CBDCs: where do we stand in Europe? at flow.db.com

5 See clearstream.com

6 See T-day for the EU? at flow.db.com