November 2024

Trade resilience endures and Asia growth accelerates, reports ICC Trade Register 2024

On 28 October 2024, the International Chamber of Commerce (ICC) Banking Commission (ICC Banking Commission) published the 2024 edition of the ICC Trade Register (the Register) in its entirety for download. Until now, only a summary version was available in an open access format.

Resilience of trade

“The 2024 Trade Register once again demonstrates that trade, supply chain and export finance products continue to exhibit low-risk profiles,” says Krishnan Ramadurai, outgoing Chair of the Trade Finance Register project (the recruitment of his successor is underway). “Despite the economic and geopolitical challenges faced in 2023, the data confirms that these products remain resilient, with low default rates and strong recovery potential across various regions and product types. This resilience reinforces the importance of trade finance in supporting global trade flows, especially during times of uncertainty.”

The Register notes “As the shift towards open account trade, accelerated digitisation, and the focus on sustainability and supply chain resilience continue to shape the sector, there are significant opportunities for growth in trade finance. The data supports the longstanding conclusion that trade finance remains a low-risk asset class, even in regions where economic challenges were most pronounced.”

“In its 13th year after being established, the ICC Trade Register proves its relevance and importance to the trade finance community”

Christian Hausherr, Product Manager for SCF at Deutsche Bank and member of the ICC Trade Register Steering Committee says, “In its 13th year after being established, the ICC Trade Register proves its relevance and importance to the trade finance community. Since then, the data approach as well as the scope of the Trade Register have been materially enhanced by the team that is managing the publication process on an annual basis. As of today, the Trade Register offers a unique view not only on trade finance risk, but also provides valuable macro-economic insights to its readers.”

The 2024 Register, published in association with The Global Credit Data Consortium and the Boston Consulting Group (BCG) includes a comprehensive review on credit risk performance of trade finance for the past 13 years, across products and regions where supply chain finance has reached a good level of maturity. Trade finance continues to demonstrate its resilience in the face of considerable geopolitical and macroeconomic turbulence.

Changing trade patterns

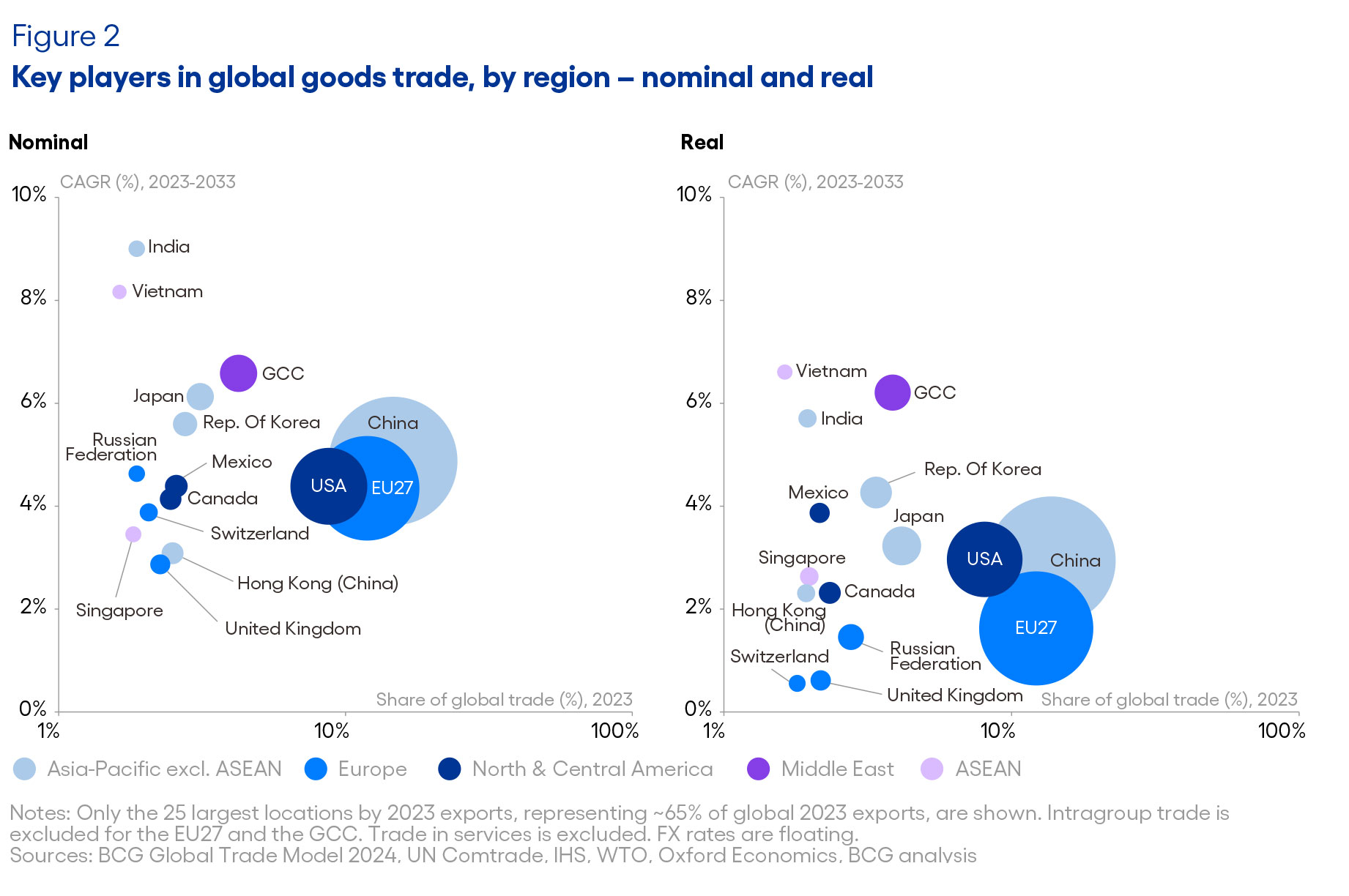

While all 48 pages provide useful insights into the overall picture of trade and how it is financed, it is the analysis of ‘Key players in global goods trade by region’ on page 15 that offers a particularly helpful picture of relative nominal (current prices) and real (constant prices GDP). The Register highlights how emerging economies are forecast to drive much of the growth in global trade over the next decade and outlines how ‘Global South’ is expected to see “strong growth” in both ‘South-South’ and ‘South-North’ trade. In addition, the Register demonstrates how the EU is diversifying and de-risking supply chains away from Russia and, increasingly, China. EU trade relations with the US, India, Japan, Korea, and Africa are expected to strengthen. The Register also confirms Deutsche Bank’s own analysis of India’s rising star.

Figure 1: Key players in global goods trade, by region – nominal and real GDP

“India, meanwhile, is expected to experience even faster trade growth in nominal terms, projected at a 9% CAGR over the next decade, in line with its GDP growth. As a rapidly emerging platform for both its domestic market and global exports, India is attracting increasing trade and investment,” states the Register.

Background

This International Chamber of Commerce (ICC) Trade Register Report was developed from “path-finding work done during the global financial crisis of 2007–2009 by the World Trade Organization (WTO), the Asian Development Bank (ADB), the ICC Banking Commission, and various other partners and policymakers”. Deutsche Bank is one of 22 members of the ICC Banking Commission.

The full report can be downloaded from the ICC Banking Commission website here