Services facilitate compliance with increasingly stringent regulatory requirements, support you to navigate the complexities of operating in multiple jurisdictions, and help you meet rising customer expectations.

dbXadvise

Three-pronged approach

✓ We strongly advocate risk-based supervision and controls, so that we can safely bank countries and communities and not keep them cut off from the important lifeblood of cash and trade.

✓ We support you to demystify market and industry initiatives to help capitalise on growth opportunities and shield you from unnecessary expenditure.

✓ We take an active role in future-proofing the correspondent banking industry, allowing you to benefit from our own investments and innovation.

Videos

17 September 2025

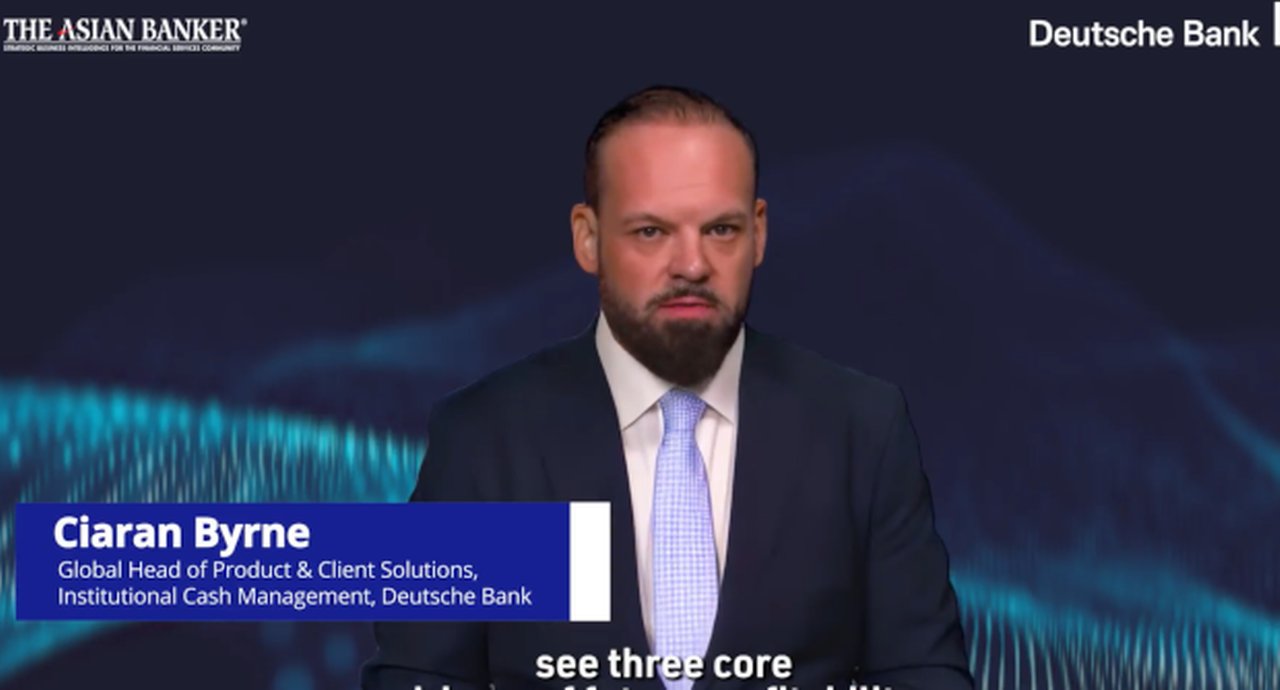

Reimagining profitability: Data, technology, and strategic alliances Reimagining profitability: Data, technology, and strategic alliances

Banking profitability is being redefined. It is no longer just about efficiency; but becoming a key partner in clients' value chains. At Deutsche Bank’s Institutional Cash Management, we see the future of profitability is driven by Embedded finance, Data monetisation and Next-gen infrastructure – enabled by strategic partnerships with Fintechs and tech firms. Ciarán Byrne shares his view.

15 September 2025

Ecosystem of risk management and partnering to solve complex issues Ecosystem of risk management and partnering to solve complex issues

At Deutsche Bank's Institutional Cash Management, we see risk as an interconnected ecosystem where partnership, shared responsibility, and transparency are key to enabling access and inclusion across global financial systems. Building resilience relies on 4 fundamentals - Shared Risk Appetite, Empowered People, Radical Transparency and Culture & Passion. Matthew Probershteyn shares his view.

9 September 2025

Global correspondent banking trends Global correspondent banking trends

Correspondent banking is shifting from slow, manual processes to a real-time, data-rich ecosystem linking fiat, tokenised, and digital currencies. At Deutsche Bank's Institutional Cash Management, this transformation is driven by 3 key pillars: Distributed Ledger Technology, Artificial Intelligence and Innovation and Open Infrastructure. Patricia Sullivan shares Deutsche Bank’s vision.