Protecting your Haus

FX Hedging: Rules based peace of mind

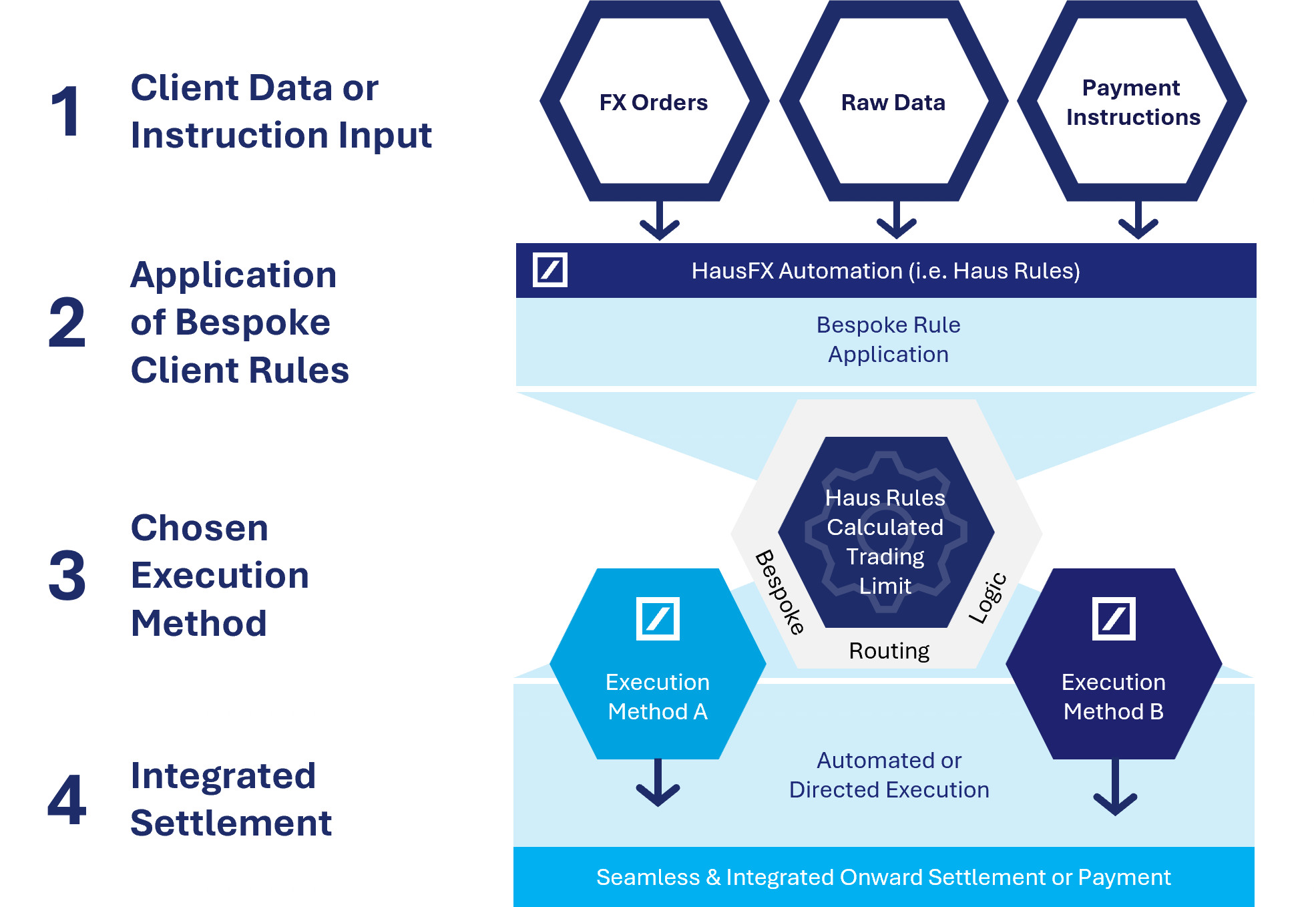

Currency risk management is essential for investment managers, asset owners, and corporations alike. Our advanced suite of tools manages your FX exposure precisely to your specifications, freeing you to focus on your core business.

Rely on our robust proprietary technology to eliminate the administrative burden of FX management.

Comprehensive front to back solutions.

Haus Benefits

FX share class hedgingAims to protect non-base currency investors from the performance impact of valuing their fund holdings in a currency other than the fund's base currency. |

|

FX portfolio hedgingHelps protect investors from the FX impact of a fund investing in overseas investments denominated in a different currency to the fund's base currency. This can be done via a predefined (static) hedge ratio, or a flexible (dynamic) hedge ratio. |

|

Balance sheet FX hedgingAims to mitigate the impact of FX volatility on the company's financial position, stabilising reported assets and liabilities by remaining FX neutral. |

|

Cash sweeps & rollsEfficiently monitor currency positions automatically converting excess liquidity to the needed currency, optimising cash positions. |

|

HausFX agencyStreamline your operations whilst Deutsche Bank acts as agent and competes your flow within the interbank market, trading on the best price, storing losing quotes to help clients evidence their best execution process. |