Welcome

What an exciting week! Sibos 2021 ran as a digital event from 11-14 October at www.sibos.com.

An exclusive Guide to Sibos 2021 and the Deutsche Bank Festival of Finance, with unique perspectives on this year’s discussion points together with a day-by-day guide to recommended sessions can be downloaded here. The Guide includes some short articles from a range of experts touching on this year’s Sibos conference themes.

The Deutsche Bank Festival of Finance brought you a number of in-depth supporting sessions over the Sibos conference week. If you missed any sessions you can view them on demand by accessing the link below.

Click on each tab to read the short daily summary of the top five selected takeaways on Sibos and the Festival of Finance brought to you by the Corporate Bank Editorial Marketing team.

See you next year in Amsterdam!

Daily takeaways from Sibos and Festival of Finance

This time six years ago we gathered in Singapore for Sibos 2015. Even back then, recurring themes were sustainability with the UN having just published its Sustainability Development Goals, and the power of big data, analytics and digitalisation to reshape the entire ecosystem. Although Sibos 2021 was unable to reconvene as planned in Singapore (home to the second largest container shipping port in the world), virtual conversations at Sibos 2021 and Deutsche Bank’s Festival of Finance event running alongside on this first day all demonstrated how momentum builds into tangible impacts and outcomes.

Five takeaways from Day 1

1. Covid-19: Resilience and learning points.

SWIFT CEO Javier Perez Tasso, our flow cover star in 2020, made the point in his 2021 welcome address that the pandemic has seen everyone go digital in a big way in their daily lives (such as working from home and meeting via Zoom), and how we have seen “accelerated change in the business environment”. He said, “It has really impressed me how the financial services industry as a whole has not just maintained business as usual, but has got great momentum in its own transformation”.

HSBC CEO noel Quinn, who took up the leadership role at the banking group in March 2020 just as the pandemic hit, paid tribute to his staff for tackling the increased pressure and responsibility. “We realised we could not make all the decisions from the centre,” he recalled. “You had to delegate and empower people to get on and make things happen. Our colleagues in 64 markets made it happen. We learned that in the face of adversity you can get things done that sometimes you think you cannot get done.” Quinn pointed out the US$41bn lent to customers in the first eight weeks of the pandemic was done entirely by colleagues working from home. “Don’t think you have to invent it at the centre. Sometimes what comes to you from your engagement process with clients and staff will give you far more insight than just trying to think you’ve got the answer.”

2. ESG and Covid are reshaping trade flows

In the Festival of Finance opening session Rethinking how to serve the economy to ensure efficient and safe supply chains (pictured above), Deutsche Bank’s Global Head of Trade Finance & Lending and Institutional Cash Management, Dr Rebecca Harding of Coriolis Technologies and Dr Tobias Miarka, Co-Head of Banking, Coalition Greenwich, looked at how, “the consequences of the Covid-19 crisis continue to play out across the European trade finance industry, as companies seek out support and advice amid lingering disruptions in business operations, supply chains and trade flows” – in the words of the just published Greenwich Coalition research, European Trade Finance: Pandemic Pressures Persist.

The shift from the global supply chain to more regional supply chains is not new, explained Harding. “We have seen a growth in intra-regional trade, regions are trading more with themselves, as they seek to ensure supply chains are as short as possible.” Supply chain diversification and distribution has a huge trade finance consequence, looking at several country sources and how to move flexibly between them. Closer control of supply chains improves scope for ESG transformation. Miarka commented that the research revealed that while corporates articulated a huge need to move towards a more ESG compliant way of working, many of them did not yet know what banks could bring to the table for helping them achieve this. “I am optimistic that the banks can be a true intermediary that can combine and transfer ideas,” he added.

Rethinking, recycling and taking care of our resources will help us get thorough the next phase, said Schmand. “We are in that transition and banks have a critical role to play,” he concluded.

This role was discussed further along with the evolving regulatory framework when Deutsche Bank’s Sibos 2021 STAR Scholar Adriana Seidl interviewed her peer Jonas Haggart from the Bank’s ESG Client Solutions team later in the day’s Festival of Finance programme. Haggart made it clear that despite the progress made in regulation and standards so far, it is “it is important to investors that there is a common sustainability reporting standard to assess which companies are performing and which are lagging behind”. He added that some of the frontrunners aligned C Suite compensation with specific sustainability objectives.

3. Big data and analytics are the present and future

Professor Michio Kaku on Brain Net

Traditionally the Innotribe opening speakers sets the scene for much of the conference, taking delegates outside the transaction banking world to second guess the future. Dr Michio Kaku was no exception. A professor of theoretical physics, he walked us through how “wealth comes from physics”. First we had the industrial revolution thanks to the laws of thermodynamics. Then came the laws of electricity and magnetism, third was high tech – quantum theory. “The wonders of today’s technology, such as computers and the internet came from quantum physics”. He then took us into the future with “Brain Net”, where “the neural architecture of the living brain would create images and send messages”. Smart bathrooms would examine human waste and provide vital diagnostics. “Oil was the thing that propelled the first three revolutions but now it is data that drives the new generation – but how do you take mountains of meaningless data and find the needle in the haystack? It is all about pattern recognition and this is the new prospecting,” concluded Kaku.

At the Festival of Finance, Smarter Custody: AI and Securities Services with Deutsche Bank’s Boon-Hiong Chan (Global head of Securities Market & Technology Advocacy), Mike Clarke (Global Head of Product Management, Securities Services joined by Johnny Wijaya, Head of APAC innovation Centre , Enterprise Innovation, BNY Mellon considered whether AI projects should be the domain of IT or the wider business. On outsourcing AI development, this, agreed the panel, should only be considered by banks if the technology is supporting them in a process which is non-competitive. If banks are looking to leverage AI in a competitive business activity, then they should look to build the technology themselves. “AI cannot function properly without excellent data. This is why providers such as Deutsche Bank have spent a huge amount of time curating data and getting to grips with its lineage before delivering this information to the Bank’s vast data lake, said Clarke.

Investment in data analysis capability came up in the Sibos Session, Navigating the API labyrinth, featuring a panel that included UniCredit Head of Transaction Banking Luca Corsini (pictured top right) and J.P. Morgan’s Global Head of Digital Channels Wholesale Payments Lisa L Davis (pictured lower left). They observed that while the cost of API capability development was “very high” the business case for investing in APIs to enable real-time treasury and instant payments was about adding value to the data that banks could provide to their clients.

4. Banks will continue to be intermediaries in a CBDC world.

Central bank digital currencies (CBDCs) are the digital form of cash and regulated by the monetary authority or a regional financial authority, typically a central bank. They are operated and settled person to person in a decentralised manner rather than via an intermediary. See the flow article CBDCs and the impact on cross-border payments for further information. In Episode 4 of Sibos TV, Deutsche Bank Corporate Bank’s head Stefan Hoops remarked on how CBDCs put central banks in competition with each other and forecast that commercial banks would continue to be the intermediary between central banks and their clients (along with fintechs). “Central banks don’t provide credit,” he said. “We as banks store value transfer value from money and we allow value to time travel. We allow you to consume something today and promise to repay it tomorrow. These are basic functions we fulfil and that will not change.” However, it is important that banks continually examine these roles and check their application in the new ecosystem, he concluded.

5. Why zero settlement fails is not the answer

In a Sibos session moderated by Dominic Hobson (pictured above left) of consultancy Hobson Cardew, speakers from Euroclear Bank, The Stock Exchange of Thailand Group, Clearstream Banking and BNY Mellon Direct Custody, noted that although trade settlement failures cost the industry €3bn per year in Europe alone, markets with settlement fail rates of less than 5% are generally considered to be quite efficient.

While tackling decreasing settlement fails has become an urgent industry priority, a race to achieve net zero settlement fails could cause unintended consequences. The overwhelming majority of settlement fails are caused by problems related to the funding and/or inventory of the assets in question. Interestingly, hardly any fails are caused nowadays by incomplete or inaccurate standing settlement instructions [SSIs], which is indicative of the excellent progress that the industry has made in this area.

Settlement fails can be mitigated through effective data sharing between industry participants, something which could be facilitated by centralised data sharing platforms. Mandatory discipline regimes such as the Central Securities Depositories Regulation [CSDR] penalty requirements and buy-ins could help stimulate settlement efficiencies.

In addition, collaboration between market participants will be a critical enabler towards reducing settlement fails.

A number of FMIs (financial market infrastructures) in developed markets including the US are openly talking about reducing the trade settlement cycle from T+2 to T+1 or even T+0. But as explained in the flow article, Accelerated settlement – the move towards T+0, potential barriers include concerns about pre-funding and issues around technology.

Image © 2021 SWIFT

“Like the concluding part of a movie franchise, the themes of previous Sibos events seem to be maturing into use cases,“ noted Sibos Insider at the end of Day 1 of Sibos. This observation was spot on, with action replacing discussion and the momentum accelerated on Day 2, with sessions demonstrating that innovation, intent and ideas do turn into actions.

Five takeaways from Day 2

1. Central banks are expanding their mandates

As US President of the Official Monetary and Financial Institutions Forum (OMFIF), Patricia Haas Cleveland (pictured above, left) was an ideal choice of moderator for a session that explored “What should a 21st century central bank look like?” In the face of greater public and private sector dialogue, the impact of innovation and digital finance, central banks are looking again their mandates.

The panel comprised (from right to left above) Ulrich Bindseil, Director General of ECB Europa, Howard Lee of Hong Kong SAR China, and Georges Elhedery, Co CEO of Global Banking and Markets at HSBC Group.

Climate change financial risk is now regarded as a systemic issue, and central banks are looking at ways including this in their strategic frameworks. Some supervisors are developing climate change taxonomies, while others are looking to impose green stress testing and capital requirements on financial institutions. On stress testing of green assets, central banks are treading a delicate balance. If they adopt a laissez-faire approach to stress testing of green assets, financial institutions may not be sufficiently incentivised to transition their exposures away from fossil fuels to greener assets. In contrast, if the measures are too strict, central banks risk pushing the financing of polluting sectors into less regulated corners of the market. In the context of recent energy shortages, central banks need to be careful not to rush the green transition as it could potentially disrupt energy supplies.

The ECB’s Bindseil explained that the ECB had published a strategy framework in July 2021 that included climate change as topic that needed further work. “Answers on how to operationalise this in the framework were not set out,” he said. In the face of greater public and private sector dialogue, the impact of innovation and digital finance, central banks are looking again at their mandates.

Developing the topic addressed by Deutsche Bank Corporate Bank’s Dr Stefan Hoops in Episode 4 of Sibos TV, the discussion inevitably turned to central bank digital currencies (CBDCs). A number of central banks are conducting proofs of concepts into CBDCs by assessing their viability in areas such as cross-border payments. There are concerns about unregulated crypto-assets such as bitcoin with experts expressing disquiet about their volatility; pricing and unsustainable energy consumption.

2. SWIFT Transaction Manager is key to a successful ISO 20022 migration

Last year, ahead of Sibos 2020, SWIFT announced a new strategy that it planned would, over the next two years and beyond, help to deliver instant and frictionless end-to-end transactions. A year later, Stephen Gilderdale, Chief Product Officer, SWIFT, introduced a panel that explored a key part of this initiative: the Transaction Manager. “The concept of transaction management takes away the operational burden from the banks, meaning that SWIFT is not only tracking the transaction, but making sure every part of the end-to-end process happens when it should”, he explained.

In other words, as SWIFT puts it on their website, “the migration to ISO 20022 can only be successful for the industry if every party can continue executing cross-border payments messages in the format supported by their internal applications. This huge industry undertaking requires a well-managed co-existence period, enabling all banks to upgrade their infrastructure to support ISO 20022 at their own pace. The SWIFT Transaction Manager makes this possible.”

Joanne Strobel, Head of Technical Solutions, Global Payment Services, Wells Fargo Bank (pictured above, lower right), shared her excitement at the host of benefits set to be unlocked by the platform. “The potential to validate up-front means that all the data will be present before the payment is delivered – minimising costly exceptions, while providing a better end-to-end client experience,” she said. “Perhaps the biggest opportunity, however, is the potential for integration with a variety of networks, rails and third parties – and how we can manage this to provide better services for our customers.”

Echoing Strobel’s thoughts, Paula Roels, Head SWIFT and Market Infrastructures, Deutsche Bank (pictured above, upper right), added, “We need the Transaction Manager to enable interoperability among all the SWIFT banks and to bridge the different formats. It will eliminate the most critical pain point we anticipate – namely, the potential for data truncation.”

At the heart of the new platform is the new ISO 20022 messaging format, which will provide participants with better, more structured data. Roels said, “The current lack of granular and structured data causes breaks in automation. It is a pain not just for banks, but also for the end client – and hinders efforts related to anti-financial crime. The richer data provided by ISO 20022, however, will mean faster processes, lower costs and will empower the next stage of digitalisation.”

3. Low-value payments will also enjoy end-to-end transparency

During Day 2 of Deutsche Bank’s Festival of Finance, we heard that while SWIFT gpi had made huge strides in removing friction from high-value payments, there is still not enough visibility around transactions that are lower value. This comes at a time when the community is under pressure – not just from the high expectations of customers, but also from new entrants that are offering services for retail and low-value payments. “Our top priority when developing SWIFT Go was predictability upfront – to ensure that a bank is able to indicate how much the payment will cost and when it will be credited,” explained Sebastian Rojas, Head of Product, Payment Solutions at SWIFT.

Gayathri Vasudev, Head of Global Clearing Product, JP Morgan (pictured top, above) noted that the SWIFT Go launch played nicely into the bank’s own plans to offer multiple pay-out methods to clients, including ACH and instant payments, already underway via its Paydeck solution.

The reasoning here is that services need to mirror what end customers need – and that is the ability to make payments to multiple end points. “If I make a payment to my sister in another country,” noted Vasudev, “I want to use the cheapest rails. If I send her US$100, I want her to receive US$100, with no deductions along the way. And I want to pay her the way she wants to be paid – whether it’s into her account via ACH or instant payments, or into a wallet.”

Marc Recker, Global Head of Product, Institutional Cash Management at Deutsche Bank (pictured lower left), agreed that the network is critical. “The biggest asset we have as correspondent banks is the network,” he said. “If we can provide access to the reach of 12,000 banks across the globe, there is no solution that can compete with the correspondent banking industry.”

Close to 70 banks have signed up to SWIFT Go, with many more expected to join. The next step is to align the initiation process with customer needs and expectations, lowering barriers to execution.

“If you can send a payment to a foreign country via email address or you can send it via an IBAN and BIC code, the email address approach is going to be easier. We need to think about how we simplify the initiation side to overcome the complexity that we have been managing with for decades” added Recker.

4. AI and machine learning need continual sense checking but the rewards are huge

The Sibos Academy session from artificial intelligence (AI) researcher and data scientist Vasant Dhar, Introduction to technology and getting the human angle right, provided a timely sense check of who controls what.

“You have to recognise where the machine is on the edge of its capability – where the autopilot goes wrong on a plane,” he said, adding that the balance of human and machine has to be addressed. “We can end up being treated like cogs in an impersonal machine that doesn’t understand what it means to be human and to correct errors,” he warned.

This presentation formed a useful filter for the lively session Harnessing the power of community to deploy AI@scale, where Deutsche Bank’s Chief Product Officer of the Corporate Bank (and ex fintech employee) Rafael Otero explained how machine learning and pattern recognition are applied to use cases such as trade finance documentation. “We need to have partners like SWIFT to help us challenge the status quo,” he observed. The tools needed are predictive analytics and anomaly detection in cross-border payments, document recognition around trade finance and neuro-linguistic programming in everything we want to do on the operations side.

Also on the panel was Tom Siebel, the founder of customer relationship management (CRM) software company Siebel Systems (and now CEO of C3.ai) whose company deploys AI to provide predictive solutions in the energy, aerospace, telecoms and financial services industries. He sees all CRM, supply chain, cash management, AML and wider financial services systems becoming predictive with AI embedded.

5. Collaboration and simplicity will help recovery

With two very different global bank View from the Top presentations, the big theme that resonated from other sessions was the need to keep on collaborating – with regulators, infrastructure providers and fintechs, to name but a few.

Unprecedented change has made this non-negotiable. “The winds of change are blowing harder than ever and though none of us are strangers to change we are in the midst of a once-in-a-lifetime shift,” said Citi CEO Jane Fraser (pictured, above). Specifically, she identified the upcoming transition to the ISO 20022 standard as a “must” for the industry, as well as the important role CBDCs will likely play in the years to come. For these initiatives – and more – to be a success, Fraser emphasised the need for cross-industry collaboration.

A year ago Frédéric Oudea, CEO of Société Générale (pictured above), commented that bankers were the “doctors of the economy”. When asked if he continued to hold the same view today, he replied that banks can “collectively be proud of what they have achieved so far”. In March 2020 as coronavirus spread globally and economies closed, the first thing corporates checked was their cash position, and banks were a vital source of liquidity.

In response to the question of how the industry will cope long-term, Oudea remarked that “most banks have a very sound starting point” and the “main financial impact is public debt” that accumulated during the pandemic, which is why it is important to have strong economic growth to mitigate it. He added that having seen some “big mergers”, standardisation and simplicity of process was important for everyone.

Image © 2021 SWIFT

The third day of Sibos, just when energy levels sometimes drop off a little was an absolute feast of insights, and on-the-ground practicalities that continued the overall momentum of using technology to simplify and protect – as well as support sustainable finance. Today’s highlight selections take a look at cyber security, digitalisation of trade, instant treasury, more on ISO 20022 and catches up with a former flow cover star, Euroclear’s Lieve Mostrey.

Five takeaways from Day 3

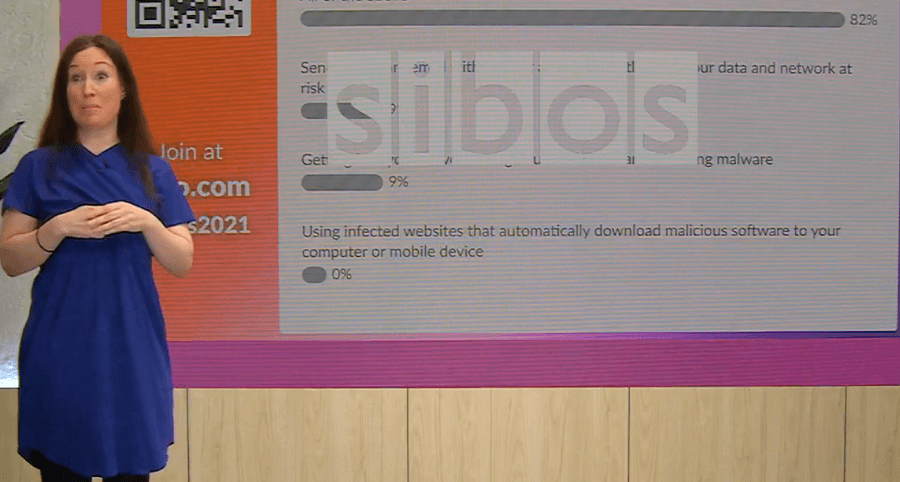

1. Cyber-crime is digital, growing exponentially, and targeting systemically important entities

Swift’s storyboard during the Fighting fraud: AI, ML and the power of data session (copyright SWIFT 2021)

New technology such as AI and machine learning (ML) is rapidly becoming the battleground for the fight against financial crime. “We see how the threat actors are constantly morphing their scams and saw a rise in impersonation this year, “opened Mary Rosendahl, Managing Director, Global Transaction Services, CashPro at Bank of America in the session Fighting fraud, AI, ML and the power of data. HSBC’s Global Head of Digital GLCM Nadya Hijazi reported how scammers were relying on the fact that many banks do not match the beneficiary name with the account number, but once this was addressed, they changed the approach to phishing to get in front of screen where a beneficiary confirmed their account and name did match.

This was just one example of how as quickly as regulations come out and the patterns become clear to those fighting financial crime, the attacks continue to morph. Potential victims need to remain on top of the next set of threats and scams to be aware of.

Continuous education is one answer (something Deutsche Bank’s Chief Information Security Officer for the Americas highlighted in the flow article “Cyber security and fraud protection” (June 2020)). Another, according to Amazon Web Services’ Business Development Head Zoe Hillenmeyer, is ensuring that the balance between protecting the customer experience and reducing friction is intuitively managed. Machine learning technology coupled with the human insights of an expert in understanding the psychology of a fraudster is a powerful antidote.

The panel also agreed that many companies struggle with unprecedented amounts of data – “they cannot protect what they don’t know they have got” – and some means of sharing data in an anonymised way to understand scammer patterns and create defences would be hugely beneficial.

Cyber criminals set out to target large organisations such as global banks, custodians and financial market infrastructures. In the session, The rise of big game hunting, Dianne Kelley, CTO and co-founder of SecurityCurve pointed out there had been a 93% increase in ransomware attacks in 2021. Moderator, Virginie O’Shea, founder of Firebrand Research (pictured above) reported that the average financial services firm spent around US$2m dealing with these incidents.

“As long as the attacks are successful, there is an incentive for cyber-criminals to continue on the path they are on,” says Brett Wallace, Director of Cyber Security Operations at J.P. Morgan Chase. In order to mitigate the likelihood of such attacks, staff education about cyber-security and phishing risks is pivotal as is support from the C-suite.

In terms of vulnerabilities, Kelley said that while large banks usually have a solid grasp about cyber-risk, smaller – or regional- financial institutions are often guilty of assuming they will not be targeted by cyber-attackers. Wallace also warns that financial institutions need to ensure that their critical third party service providers have solid cyber hygiene measures in place.

2. Trade digitalisation really is happening at last

Digitalising trade was a hot topic of panel discussions six years ago in Singapore and, unlike payments, has large numbers of stakeholders on the transactional journey. But given that some put the trade finance gap at as much as US$3trn, almost entirely comprising SMEs, the urgency to find a solution has never been greater..

As Deutsche Bank’s Daniel Schmand explained in his Sibos video interview with The Banker, large international banks rely on domestic banks to do the required KYC checks on smaller clients. In open account trade finance, initiatives such as the Trade Information Network (TIN) are an effective way of supporting SMEs through the purchase order process.

In Day 3 of Deutsche Bank’s Festival of Finance we heard how the TIN enables corporates to easily and securely communicate trade information directly with banks of their choice, via a global multi-bank, multi-corporate network in trade finance. Earlier this year, the first real transaction – involving F. Hoffmann-La Roche AG (Roche), Targos Molecular Pathology GmbH (Targos), and Deutsche Bank – was executed on the platform.

Reflecting on the pilot transaction, Jens Noffke, Working Capital Lead, Global Procurement at Roche (pictured above, lower left), said, "when Roche works with suppliers it often means initial cash outflow for them, creating a need for financing very early in the process rather than at the end when the invoice is issued – and TIN addresses this need very well. The feedback has been positive – from onboarding to requesting financing the platform worked very smoothly. In fact, Targos ended up submitting two purchase orders because of how easy the platform was to use".

For Sudhir Dole, Chief Executive Officer for TIN (pictured above, upper right), one of the strengths of TIN is not only that it reduces risk and increases opportunities for additional finance, but that it is agile and being continually improved upon. “It helps to reduce the risk of fraud as the buyer is getting the information from the original source.

Further information about the Roche and Targos experience can be found in the flow article, ‘Financing purchase orders – the best medicine’.

Returning to the theme of making digital trade finance happen, the Sibos panel session held on 11 October, MLETR: The unsung hero of trade digitisation, discussed progress on the adoption of the UNCITRAL Model Law for Electronic Transferable Records. Legal acceptance of digital documentation remains a huge barrier. SMBC’s Head of Legal Sean Edwards (who also chairs the International Trade & Forfaiting Association) explains, “MLETR is a foundational step in allowing trade finance digitisation to happen as banks and other adopters recognise that a market in traditional trade instruments is both possible and desirable but cannot happen without legal certainty. That’s why the G7 have picked this up as a major priority and important international and regional jurisdictions are in the process of changing their laws, or have already. The changes, in legal terms, are relatively simple but incredibly powerful in effect: it’s basically about achieving equivalence but, by doing so, an important and proven market can begin to enjoy the cost-effectiveness and global penetration of new technology and networks.”

3. While the payments industry has made excellent progress adopting ISO 20022, securities markets have some catching up to do

With SWIFT’s migration to ISO 20022 now set for November 2022, and with other domestic Real Time Gross Settlement (RTGS) systems moving at a similar time, preparation for the transition has now become a matter of urgency. In the Festival of Finance Deep Dive into Deutsche Bank’s Guide to ISO 20022 Migration part 4, Simon Jones, High Value Payments Tribe Lead and Global ISO 20022 Program Director, Deutsche Bank, touched upon the lessons learnt from the migrations so far, stating that “it is really important to start testing early. It is not just about the technical testing either, it is about working with the operations team to ensure the end-to-end migration will go smoothly.”

According to Christian Fraedrich, Head of Cash Business Architecture, Deutsche Bank, SWIFT’s preparations will bring about a host of benefits for clients. “It will play a critical role in reducing the dependency on the weakest link in a payment chain – helping to overcome the challenge of data truncation. The data immutability end-to-end will also be critical for reconciliation.”

"SWIFT is playing a critical role in these preparations – and we are currently focused on the details of the migration to ensure every participant knows what they have to do,” explained Stephen Lindsay, Business Lead, SWIFT Platform. He stressed that – regardless of whether you go live with ISO 20022 straight away or not – at the very least, participants will need to ensure their SWIFT interface is upgraded to receive and process these new messages.

While the payments industry has made excellent progress adopting ISO 20022, securities markets lag behind. This is partly because there has been little buy-side and securities services appetite for ISO 20022. While activities such as corporate actions and proxy voting could benefit from ISO 20022 adoption, many within securities services do not believe there is a business case for embracing the standard given the costs and effort that a transition involves. ISO 20022’s rather limited adoption in the securities industry has been mostly driven by regulations such as the Shareholder Rights Directive 2. In order for the industry to accept ISO 20022 more readily, it will need to co-exist with ISO 15022, commented Juliette Kennel, Head of Standards at SWIFT in the Sibos panel session Realising data opportunities in the securities industry (pictured above, far right).

Vicky Kyproglou, Head of Network & Market Infrastructure Management at UBS (pictured second right), noted that the industry has woken up to the importance of data. For example, data analytics is often leveraged by banks for internal purposes (e.g. group-wide compliance and risk management) while insights gleaned from data analytics are also shared with underlying clients, she added.

Nonetheless, issues persist around data interoperability and standards, or the lack thereof. Owing to the patchwork of different data communication channels and the increased use of bespoke APIs and distributed ledgers, fragmentation and duplication are major risks. In order to enhance and improve data sharing processes, the industry is being urged to adopt ISO 20022. Stuart Warner, Head of Direct Custody and Clearing Product, MENAT and Americas, Securities Services, HSBC, suggested ISO 20022 be leveraged so as to simplify the API (plus DLT) landscape by enabling interoperability. This will help custodians execute their digital transformation strategies and further streamline client communications.

4. Instant treasury is all about the right data

The concept of an instant treasury has long been at the top of the agenda for corporates, but what exactly does it mean? This issue provided lively discussion in the Sibos panel moderated by TMI Editor Eleanor Hill (pictured above, left), Instant treasury as a service: Can banks give corporates what they need? For Christof Hofmann, Head of Corporate & Payment Solutions, Deutsche Bank (pictured lower right), "instant treasury is not only about instant payments and collections, it is about a treasurer having access to the right data, at the right time, in order to make the right decisions.” In this sense, it does not necessarily have to be in real time, but it does need to be available in all critical moments. Lori Schwartz, Global Head of Liquidity and Account Solutions, J.P. Morgan (pictured lower centre), agreed with Hofmann’s take, stressing that “it is not about data just for the sake of data, it is about ensuring the data can be leveraged to make actionable decisions”.

Asked what the benefits of instant treasury are, Sharon Wang, Treasury Director, ALIBABA.COM (pictured upper second left), explained that the broad benefits are speed, transparency, integrated information, and process simplification. “Instant payment information enables more streamlined, dynamic supply chains, instant information reporting can minimise manual inquiries and a continuous real-time view of cash can help us to meet our liquidity management demands,” she added. This understanding is not unfounded either, with Alibaba having already implemented a number of innovative treasury solutions, including an AI chatbot to provide a real-time view of underlying transactions.

Though these innovations are impressive, Hofmann was keen to emphasise that those who are just starting their journey should not be discouraged. “Not everything needs to be real time tomorrow, and there is, in fact, a benefit in picking the processes that are most relevant and building from there,” he added. But the onus is not all on corporates. Hofmann conceded that banks have a bigger role to play: “There is more we need to do as an industry to work together to ensure we are the best that we can be for our clients – and embracing multi banking, as well as efforts to standardise processes, is going to be critical for this trend."

See also the Deutsche Bank white paper, Instant payments – a guide for corporates.

5. Market infrastructures can help issues and investors with sustainable finance choices

Euroclear CEO Lieve Mostrey in one of Day 3’s View from the Top sessions

The up and coming settlement discipline regime of CSDR has made it really important for market infrastructures such as Euroclear support clients with analysis of their settlement activity. They have AI tools to help them detect where fails could be anticipated in settlement activity and avert the penalties that go with that, said Euroclear CEO Lieve Mostrey in one of today’s View from the Top sessions.

Mostrey, who graced the front cover of Deutsche Bank’s flow in 2017, reflected on the data – and with it the opportunity (and responsibility) generated by the €35trn of assets it holds and the 280 million securities transactions Euroclear settles each year (with a value of almost €900m).

“The data angle is a new business angle for ourselves and we have put a lot of investment into it, she said.

Another key area where Mostrey believes Euroclear can make a difference – through its reference data – is in sustainable finance. She had viewers downloading the Sustainable Finance white paper published in collaboration with PwC (September 2021), which identified the difficulties in scaling sustainable finance from the issuer and investor side and proposing actionable cross-border financial market infrastructure solutions to propel the market further. “It is not easy for issuers to be clear on the type of transparency needed, on use of proceeds so that they have the trust of investors,” she said.

Image © 2021 SWIFT

.jpg?language_id=1)

And now we come to the final day of Sibos – if we had been doing the 5k Fun Run this would have been the last 1250 kilometres. And what a race to the finish we had! We had seen it all in action this week: Digital Acceleration, Managing Risk, Transformative Technology and Banking on Change.

This is actually a very good time in the event to reflect on the last theme and how we should, incrementally in everything we do, assess its impact on those around us. Day Four both started and closed with powerful ESG sessions – while common themes such as hybrid working models post-pandemic and changing attitudes to what productivity really is having formed undercurrents during the whole event.

While this was a packed and stimulating virtual agenda, here at Deutsche Bank we are so looking forward to a proper reunion in Amsterdam in 2022! See you there!

Five takeaways from Day 4

1. ESG regulation, data, and demand for transparency are re-plumbing the financial system

Left to right: Elree Winnett Seelig (Citigroup Global Markets) Richard Lacaille (State Street Bank and Trust Company); Kamran Khan (Deutsche Bank ; and Martin Seimetz (Commerzbank)

In the first half of 2021, sustainable finance bonds volume surged 76% year on year to reach a US$552bn all-time high, opened Sherry Madera, Chief Industry & Government Affairs Officer at the London Stock Exchange Group, and moderator of the panel session, Mandated sustainability reporting: Beast, burden or the only way forward?

Panel member Elree Winnett Seelig, Global Head ESG Markets, at Citigroup Global Markets Limited commented, “In financial services we spend so much time thinking about ESG as a product but forget the transformational impact it could have and it is becoming a new operating system for our markets. When one third of the assets under management is integrating ESG factors into pricing risk, this will reshape our markets.”

Underpinning all of this is materiality – information that markets can trust when a company’s ESG credentials are analysed. Disclosure is all very well but what else can asset managers check?

Regarding decarbonisation, a relatively small number of sectors account for most of the production and consumption of CO2, reflected State Street Bank and Trust Company’s Global Head of ESG Richard Lacaille. So, while net zero commitments are not yet universal, the big question is whether the ones we do have are in “areas that are material in terms of CO2 production,” he added. When it comes to financial materiality, Lacaille said that asset managers are guided by independent institutions such as Resolution Foundation that help inform what specific things matter in particular industries. “In some cases this will be carbon but in others material ESG issues. “We need to ensure investors get good long-term returns so must therefore pay attention when making decisions to things that influence very long term cash flows of the companies we invest in or the credits we are supporting.”

The panel agreed that relevant and robust metrics are vital. ESG transition requires transaction models, products solutions and regulatory measures which meet international standards. Kamran Khan, Head of ESG for APAC at Deutsche Bank, explained why the ESG Centre of Excellence in Singapore launched by the bank in May 2021 helps clients on this journey. “I tell the clients that the metric they use must be credible so when a third party looks at it they know they are serious because they are measuring the right things that go to the heart of their sustainability.” The measurements should be specific and balance what is credible and achievable.

“We need to be very smart about what kind of disclosure requirements we integrate into our processes,” he added. “When it comes to disclosures, I would ask: do you want the disclosures to come from the asset managers, or do you want the disclosure to come from the corporates? My preference would always be corporates, because if corporates are required to provide disclosure on their ESG credentials, investors will be able to make smarter decisions and can be held accountable for using or not using that available, disclosed information.”

Commerzbank’s Head of Risk and Resource Steering Martin Seimetz pointed out that in Germany regulators are issuing the German Supply Chain Duty of Care Act which comes into force in January 2023. This, he said, will have a cascading effect as companies will have to beef up their transparency and show within their industry what paths they will take – something that will be shared with financing companies. He developed a point made by other panellists that “digitalisation is a means to success”. In other words, enlightened corporates are building out their core financial systems to integrate ESG data. This way reporting will improve and will help financial market decision-making.

As Mark Carney, UN Special Envoy for Climate Action and Finance (and former Governor of both the Bank of Canada and the Bank of England) put it in the Sibos closing keynote, “We are changing the plumbing of the financial system,” he said. This is happening in parallel with the Net Zero commitments that are being made so that “institutions have tools and new markets to move towards Net Zero”. He added, “we have to distinguish between broader ESG goals and the transition to Net Zero” and reminded delegates that the impact of the efforts towards Net Zero are tangible – and are far easier to measure than other factors, such as the impact on local communities, where misrepresentation can occur.

2. More could be done to tackle financial inclusion

Back in 2014 at Sibos Boston, during his closing keynote speech Microsoft founder Bill Gates talked about how financial exclusion made the poor more dependent on cash and more at risk of extortion from money lenders. He saw digital payment systems using mobile phone technology as a solution.

While the rise of mobile money in poor countries has since done much to help, more needs to be done, said HM Queen Máxima of the Netherlands and the UN Secretary General’s Special Advocate for Inclusive Finance for Development, in an interview with The Banker.

She pointed out that 63% of women in sub-Saharan Africa still do not own a mobile phone (often their husbands do), and have no personal access to financial services and the tools to make ends meet. “We need to work on digital inclusion”, said Queen Máxima, and added that SMEs and micro enterprises also need “better access” because “they create employment going forward”.

3. Friction remains in cross-border payments – but progress is being made

“I don't think you can go a day without either reading or hearing something about cross-border payments. They are top of mind for every regulator, every client, every bank and every fintech,” said Thomas Halpin, Global Head of Payment Products at HSBC, during the panel session Removing friction in cross-border payments. “This is because the payment journey today is falling short […] In fact, it’s estimated that approximately US$2.4bn is lost every year through the friction currently in the system.”

According to Isabel Schmidt, Head of Direct Clearing and Asset Account Services Products at BNY Mellon, “there are several factors that are putting the focus on faster and more efficient cross-border payments – and one of the biggest drivers has to do with the rise of real-time payments that is happening domestically,” explored Schmidt. “Nowadays, the customer experience is that everything is just one click away. We need to be able to deliver this in the cross-border payment space so that our clients can transact and conduct their own business seamlessly.”

Schmidt added that this also comes at a time when demand for cross-border payments is on the rise. “Projections for growth in B2B e-commerce are running between 25% and 35% a year. This is why we need to come together as an industry to achieve this seamless payment experience.”

“In a nutshell,” explained Marc Recker, Global Head of Product – Institutional Cash Management, Deutsche Bank, “the expectation from clients is that we remove the word ‘cross-border’ from their payment needs”. With Sibos having provided a number of updates on strategy to take the friction out of such payments, he reminded delegates of how much progress has been made. “SWIFT gpi brought transparency to the ‘black box’ of cross-border payments and now, with the launch of other SWIFT initiatives, such as SWIFT Go and pre-validation, we are moving even closer to creating a harmonious cross-border payments process. Particularly, with the ISO 20022 migration coming next year, we are certainly on the right track.”

4. Shorter securities settlement cycles need to be timed right

During Episode 18 of Sibos TV, Goran Fors, Deputy Head of Investor Services at SEB and Chair of the SWIFT Securities Committee of the Board, made the point that “the move to T+1 is challenging”. While the technology exists to make possible the move to T+0, time differences for cross-border settlement and the need to correct instructions remain barriers. He saw the work on the Unique Transaction Identifer (UTI) as key to taking this forward.

The topic of shorter settlement cycles had already cropped up on Day 1 during the discussion of settlement fails and was developed further in the session, On the road to T+0: The global trend towards shorter securities settlement cycles.

Alexis Thompson, Head of Global Securities Services at BBVA Corporate and Investment Banking (pictured above second left), recalled there were widespread fears in Spain back in 2016 that the domestic industry’s technology infrastructure would not be able to cope with the transition from T+3 to T+2. These concerns turned out to be groundless. In fact, Thompson said the whole transition process in Spain went rather smoothly in the end and so while there were no plans in Spain (or the EU) to move to a T+1 settlement cycle just yet, he was confident the securities services industry could handle such a change were it to happen.

Michele Hillery, Managing Director at the DTCC (pictured above, second right), said there was a compelling economic case for shortening the settlement cycle to T+1 from T+2. A shorter settlement cycle would facilitate lower margin requirements and risk weighted capital obligations thereby facilitating collateral optimisation and freeing up liquidity in the system. As a risk mitigation tool, T+1 can reduce settlement risk and counterparty risk for market participants. Beyond trade settlement, Hillery said T+1 could be leveraged in corporate actions as well. Panellists agree that the industry’s technology is more than capable of supporting a transition to T+1, but that the regulatory challenges which T+1 might pose need to be carefully examined.

On shifting to T+0 (i.e. same day settlement), existing technology is not a barrier either. However, the impediments to T+0 lie with the overall market structure with Thompson saying that reconciliations would need speeding up while funding issues must be overcome as well. Nonetheless, he pointed to the excellent work which has been done in the industry to facilitate instant payments through initiatives such as SWIFT GPI, adding that before there was no reason why instantaneous settlement could not be achieved in the securities world either. Again, technologies such as DLT, central bank digital currencies (CBDCs) and smart contracts could play a useful role in driving the transition to T+0.

For further explanation of settlement structures see the flow article, Accelerated settlement – the move to T+0.

5. Think like a fintech

A common theme that has emerged over the past few years is how a customer experience as a consumer shapes their business expectations. “Transforming and shaping the banking industry of tomorrow requires market and banking infrastructure initiatives to provide a seamless, secure and harmonised banking experience for our clients,” explained Kerstin Montiegel, Head of Client Connectivity/Digital Client Access Channels, Deutsche Bank in the Sibos Spotlight session, Digital acceleration: Delighting the digital customer. Strategically investing in and collaborating with fintechs helps us banks to acquire know-how, complement our own product suite and accelerate product roadmaps.”

“The Covid-19 pandemic has increased the urgency for digital solutions,” noted Andrea Melville, MD Commercial Business Transformation, Lloyds Banking Group, with clients now expecting “friction-free payments in real time". It’s a demand that can be almost dizzying to keep up with, requiring banks to strike “a balance between keeping things simple and making them hyper personalised”.

See also the Deutsche Bank white paper Client services re-imagined, co-written by Montiegel.

Deutsche Bank’s Business Analyst Shashank Gupta from the Technology Data and Innovation team (far left on the screen) talking about the spirit of collaboration on Sibos TV Episode 18

One popular Sibos stimulant of digital solutions is the annual Hackathon, where more than 50 developers from across the Sibos ecosystem form teams to collaborate and come up with real solutions to each year’s new challenges. One of this year’s was to ‘Enhancing the accuracy of anomaly detection in payments’. The other was ‘Building ‘synthetic’ data-sets required for AI-based product development, whilst protecting privacy’.

The aim of the first challenge was to see how machine learning (ML) and AI can be leveraged to better detect transaction anomalies. With research suggesting that 95% of AML-related transaction alerts are currently false positives, costing the financial services industry billions a year, this is an increasingly important focus area for the industry.

Deutsche Bank won the first challenge with the development of an AI solution, which could successfully identify the majority of fraudulent transactions. Commenting on the win, Javier Quintero, Lead Machine Learning Engineer, Deutsche Bank said, “We were able to engineer extra features that weren’t otherwise available. For example, we developed a feature that can capture the time aspect of the transaction, including how long two parties have been doing business, thereby providing a measurement for how trusted they are.”

Image © 2021 SWIFT

Session videos

Deutsche Bank Festival of Finance 2021

Session videos Session videos

Watch the session videos of all four event days on demand

Session videos Watch nowInvitation

On the occasion of Sibos 2021, we invite you to tune into expert perspectives brought to you by Deutsche Bank. The Deutsche Bank Festival of Finance will run as a digital event during the Sibos week from 11-14 October 2021 offering a range of in-depth sessions.

Agenda

Show content of Monday, 11 October

Rethink how to serve the economy to ensure sustainable and safe supply chains

Session Description:

Recent global economic and political developments coupled with the global health pandemic have triggered the need for banks to rethink how they continue to serve and support the global economy and their clients to ensure reliable and strong supply chains in the short and long-term. Key topics such as the trend to near shoring, which is influenced by geopolitical shifts and tensions, logistics, the cost and pricing environment, the increased need for natural resources, and the shift towards sustainability within supply-chains will be discussed in a panel discussion with Deutsche Bank internal and external guest speakers.

- Dr. Rebecca Harding, CEO, Coriolis Technologies

- Dr. Tobias (Toby) Miarka, Co-Head of Banking, Coalition Greenwich

- Daniel Schmand, Global Head of Trade Finance & Lending and Institutional Cash Management, Deutsche Bank (moderator)

Is the future of cross-border payments distributed?

Session Description:

Innovation in the payments space continues unabated. Spurred by the incredible pace of the digitalisation of economies that impacts on our lives, the demand for digital, global and borderless money will continue to grow.

But how do we best answer that demand? The answer may come in various forms. There won’t be a “one size fits all” approach. One thing is certain, the global pandemic has intensified digital developments especially around digital and cryptocurrencies. Although cryptocurrencies as a new financial asset class still has many sceptics, it is clear that the blockchain which underpins it continues to evolve as a powerful, decentralised alternative.

Join us for a discussion on the latest developments in the market and the potential impact on the cross-border payments business.

- Marion Laboure, Senior Economist and Market Strategist, Deutsche Bank

- Rhomaios Ram, CEO, Fnality International

- Marc Recker, Global Head of Product, Institutional Cash Management, Deutsche Bank (moderator)

Take a Break!

Relaxation Station: 9 Minute Stretch from your Desk (Adidas)

Session Description:

This 9-minute stretch session will help you relax your muscles and relieve tension. Enjoy and relax with this desk workout. We all know the stress and tension that can come from being sat down all day.

The benefits of stretching can include:

- Reduces fatigue

- Can prevent muscle strength injuries

- Improves posture

- Increases muscle coordination and balance

Smarter Custody: AI and Securities Services

Session Description:

This panel will explore the state of artificial intelligence (AI) uses in asset management and securities services, what are the challenges in deploying AI, and how much can AI drive the industry’s future?

- Boon-Hiong Chan, Global Head Securities Market & Technology Advocacy, Deutsche Bank (moderator)

- Mike Clarke, Global Head of Product Management & Head of UK&I Region, Securities Services, Deutsche Bank

- Mario Favaits, Managing Director of Faktion Pte Ltd

- Johnny Wijaya, Head of APAC Innovation Center, Enterprise Innovation, BNY Mellon3rd Panelist - TBC

on sibos.com

Sibos TV – Episode 4

Session Description:

Tune in to Sibos TV between 15:30 – 16:00 as talks of a digital euro heat-up. Juliette Foster speaks with Dr. Stefan Hoops, who heads the Corporate Bank at Deutsche Bank on Digital Currencies: A Threat or Opportunity for Banks.

- Juliette Foster, Journalist │Writer, Magnus Communications.

- Stefan Hoops, Head of Corporate Bank, Deutsche Bank

Take a Break!

Brain Games: The Pattern Game – Tracking my cash with Max Darwin, Illusionist

Session Description:

Max Darwin earned the moniker “The Amazing Max“ for his extraordinary skills as a magician and also for his ability to entertain adult audiences while keeping the little ones spellbound. In this sequence, he shows off some pattern-based magic you can use to amaze your friends.

Deutsche Bank’s Star Scholar interviews her peer on: Banking on changeSession Description:

The Sibos conference promotes industry collaboration and exchange on several topics that are, and will be, key for the development of the industry. Moreover, it encourages young professionals to network and learn from all the offered sessions.

Adriana Seidl, Deutsche Bank’s Star Scholar 2021, has taken this opportunity to create a series of short interviews with young professionals on each of the Sibos topics, to share their views.

ESG and sustainable finance are a clear demand from society, and governments are reacting by establishing such things as The Paris agreement and the UN2030 sustainable goals. As an industry, we must embrace and support ESG goals for the wellbeing of society and the environment. Today, Adriana invites Jonas Haggart to discuss ESG and its challenges.

- Adriana Seidl, Structuring for FIs, Institutional Cash Management, Deutsche Bank

- Jonas Haggart, ESG Client Solutions Team, Deutsche Bank

Show content of Tuesday, 12 October

on sibos.com

Harnessing the power of community to deploy AI @ Scale

- Penelope Crosman, Arizent

- Rafael Otero, Deutsche Bank

- Thomas Siebel, C3.AI

- Matthieu Vacaire, Société Générale

on sibos.com

Unlocking the value of CSP attestation data for counterparty risk management

- Joanne Cash, The Bank of New York Mellon

- Leif Simon, Deutsche Bank

- Frank Versmessen, SWIFT

on sibos.com

Meet the Experts: How banks can realise new FX payments revenues through innovative technology

Session Description:

In this Deutsche Bank workshop, three experts will discuss how innovative technologies such as APIs have been used by Deutsche Bank and its financial institution clients to streamline and automate cross-border payment workflows and uncover additional FX payment revenues.

- Yannick Marchal, Global Head of Autobahn Maestro Platform, Deutsche Bank (moderator)

- Jeff Smeeton, EMEA Head of Transactional FX, Deutsche Bank

- Moritz Strobel, Domain Lead for API Solutions, Cash Management, Deutsche Bank

Take a Break!

Relaxation Station: 10 Minute Meditation for Beginners with John Davisi

John is a mindfulness life coach, teacher, and speaker. Mindfulness returns you back to a place of calm, stillness, and ease. The emotional benefits of meditation can include:

- Gaining a new perspective on stressful situations

- Building skills to manage your stress

- Increasing self-awareness

- Focusing on the present

- Reducing negative emotions

- Increasing imagination and creativity

- Increasing patience and tolerance

on sibos.com

SWIFT platform evolution: Enabling industry transformation

- Stephen Gilderdale, SWIFT

- Tanja Haase, SWIFT

- Craig Ramsey, ACI Worldwide

- Paula Roels, Deutsche Bank

- Joanne Strobel, Wells Fargo Bank

Take a break!

Mentalup Brain Games: Have I Seen it or Not?

Session Description:

Play a quick brain game to test your mind!

Brain teasers and puzzles are great for staying active. But this is not just for your body, it's also great for your cognitive function too. These games help keep your mind sharp and provide a relief.

SWIFT Go – setting the standard for future cross border payments?

Session Description:

Much has been achieved towards enhancing the cross-border payments experience since the introduction of gpi. But the work is still evolving. SWIFT and the banking community continue to work closely together to further increase efficiencies, to enable frictionless cross-border payments and to meet evolving customer requirements. One such recently announced initiative is the introduction of SWIFT Go which, initially designed for low value cross border payments, builds on the foundational work of what has already been achieved with gpi.

Join us for a webinar in which our experts discuss how SWIFT Go is responding to customers’ expectations of principal pay solutions with end-to-end pricing transparency up-front.

- Bradley Lonnen, Head of Market Management, Institutional Cash Management, Deutsche Bank (moderator)

- Sebastian Rojas, Head of Product, Payment Solutions, SWIFT

- Marc Recker, Global Head of Product, Institutional Cash Management, Deutsche Bank

- Gayathri Vasudev, Head of Global Clearing Product, JP Morgan

Take a break!

Mentalup Brain Games: Face Memory Game

Session Description:

Play a quick brain game to test your mind!

Brain teasers and puzzles are great for staying active. But this is not just for your body, it's also great for your cognitive function too. These games help keep your mind sharp and provide a relief.

Deutsche Bank’s Star Scholar interviews her peer on: Transformative technology

Session Description:

The Sibos conference promotes industry collaboration and exchange on several topics that are, and will be, key for the development of the industry. Moreover, it encourages young professionals to network and learn from all the offered sessions.

Adriana Seidl, Deutsche Bank’s Star Scholar 2021, has taken this opportunity to create a series of short interviews with young professionals on each of the Sibos topics, to share their views.

FinTechs have taken over the payment industry. Nevertheless, the pandemic has created unexpected challenges within the last year. Today, Adriana invites Davor Zilic to discuss how FinTechs have struggled over the last year.

- Adriana Seidl, Structuring for FIs, Institutional Cash Management, Deutsche Bank

- Davor Zilic, Business Product Manager for FinTech & Platform Clients, Deutsche Bank

Show content of Wednesday, 13 October

Trade Information Network Update

Session Description:

The session provides an overview on the rationale of six major trade banks that founded Trade Information Network, the benefits the different parties see in engagement via the platform, and how TIN operates. It will also focus on the way the Network unlocks additional financing opportunities along the entire supply chain.

- Sudhir Dole, CEO, Trade Information Network

- Kirsten Kunz, Global Head of Trade Flow Product Management, Deutsche Bank

- Markus Maurer, Senior Product Manager, Trade Finance, Deutsche Bank (moderator)

- Jens Noffke, Working Capital Lead, Global Procurement, F. Hoffmann-La Roche AG

Take a break!

Mentalup Brain Games: MatchUp

Session Description:

Play a quick brain game to test your mind!

Brain teasers and puzzles are great for staying active. But this is not just for your body, it's also great for your cognitive function too. These games help keep your mind sharp and provide a relief.

Deep Dive into Deutsche Bank’s “Guide to ISO 20022 Migration, Part 4”

Session Description:

Since the release in 2020 of our previous paper, “Guide to ISO 20022 migration: Part 3”, the implementation of ISO 20022 around the world has progressed significantly. The first migration has already become reality in the Philippines, while the vast majority of our industry is kept stretched with pre-migration activities for November 2022. The preparations in the correspondent banking space are not limited to just the ISO 20022 migration but also the introduction of SWIFT’s Transaction Manager.

With the publication of Deutsche Bank’s Guide to ISO Migration Part 4, our experts, together with SWIFT's Business Lead for SWIFT Platform, will provide an extensive deep dive on the subject. In particular, we will outline the latest industry developments, the complexity of dealing with multiple moving parts as well as the challenges of the coexistence phase.

- Christian Fraedrich, Head Cash Business Architecture, Deutsche Bank

- Simon Jones, High Value Payments Tribe Lead and global ISO20022 Program Director

- Stephen Lindsay, Business Lead, SWIFT Platform, SWIFT

- Paula Roels, Head SWIFT and Market Infrastructures, Deutsche Bank (moderator)

Take a Break!

Relaxation Station: 10 Minute Simple Yoga Flow for All Levels with Sarah Beth

Session Description:

Sarah Beth is here to help you stretch, strengthen, tone, de-stress and peel back the layers to becoming your best self through yoga! This 10-minute simple yoga flow repeats a variation of the Sun Salutation, a sequence to engage your core & breath and improve blood flow to your whole body.

on sibos.com

Instant treasury as a service: Can banks give corporates what they need?

- Eleanor Hill, Treasury Management International (TMI)

- Christof Hofmann, Deutsche Bank

- Anita Mehra, Microsoft

- Aurelia Normand, BNP Paribas

- Lori Schwartz, J.P. Morgan

- Sharon Wang, Alibaba.com

Take a break!

Mentalup Brain Games: Spot the Difference

Session Description:

Play a quick brain game to test your mind!

Brain teasers and puzzles are great for staying active. But this is not just for your body, it's also great for your cognitive function too. These games help keep your mind sharp and provide a relief.

Deutsche Bank’s Star Scholar interviews her peer on: Digital acceleration

Session Description:

The Sibos conference promotes industry collaboration and exchange on several topics that are, and will be, key for the development of the industry. Moreover, it encourages young professionals to network and learn from all the offered sessions.

Adriana Seidl, Deutsche Bank’s Star Scholar 2021, has taken this opportunity to create a series of short interviews with young professionals on each of the Sibos topics, to share their views.

With the increase of e-commerce and the developments around digital payments, CBDCs have become a necessity for governments to ensure a secure form of “digital money”. Today, Adriana invites Vera Neidl to discuss the emergence of CDBC.

- Adriana Seidl, Structuring for FIs, Institutional Cash Management, Deutsche Bank

- Vera Neidl, Business Development Specialist, Deutsche Bank

Show content of Thursday, 14 October

on sibos.com

Mandated sustainability reporting: Beast, burden or the only way forward?

- Kamran Khan, Deutsche Bank

- Richard Lacaille, State Street Bank and Trust Company

- Sherry Madera, LSEG (London Stock Exchange Group)

- Martin Seimetz, Commerzbank AG

- Elree Winnett Seelig, Citigroup Global Markets Limited

Take a break!

Mentalup Brain Games: Card Matching Game

Session Description:

Play a quick brain game to test your mind!

Brain teasers and puzzles are great for staying active. But this is not just for your body, it's also great for your cognitive function too. These games help keep your mind sharp and provide a relief.

on sibos.com

SWIFT Hackathon 2021: Meet the winners

Take a Break!

Relaxation Station: Reset Decompress Your Body and Mind - Headspace

Session Description:

Hit reset with this 10-minute meditation session, guided by Andy Puddicombe. With many of us working from home, and social distancing becoming part of our lives, it can feel like work, family time, and relaxing all blur together. This meditation encourages us to pause and reset between tasks, helping you feel more present and better able to enjoy whatever comes next.

on sibos.com

Removing friction in cross-border payments

- Fabien Depasse, SWIFT

- Thomas Halpin, HSBC Bank plc

- Yukiko Kanai, The Chugoku Bank Limited

- Vikram Paranjpe, Citibank N.A.

- Marc Recker, Deutsche Bank

- Isabel Schmidt, The Bank of New York Mellon

on sibos.com

Spotlight on Digital acceleration: Delighting the digital customer

- Stefano Favale, Intesa Sanpaolo

- Andrea Melville, Lloyds Banking Group plc

- Kerstin Montiegel, Deutsche Bank

Take a break!

Mentalup Brain Games: Word Memory

Session Description:

Play a quick brain game to test your mind!

Brain teasers and puzzles are great for staying active. But this is not just for your body, it's also great for your cognitive function too. These games help keep your mind sharp and provide a relief.

Take a Break!

Quick Change Magic with Léa Kyle

Session Description:

Léa Kyle is a French magician specializing in the art of Quick Change. She performs around the world with her act, is a French champion of magic 2019 and participated in various television shows. Viewers will be amazed by the seamless transition of outfits making the entire experience magical.

Deutsche Bank’s Star Scholar interviews her peer on: Managing risk

Session Description:

The Sibos conference promotes industry collaboration and exchange on several topics that are, and will be, key for the development of the industry. Moreover, it encourages young professionals to network and learn from all the offered sessions.

Adriana Seidl, Deutsche Bank’s Star Scholar 2021, has taken this opportunity create a series of short interviews with young professionals on each of the Sibos topics, to share their views.

The use of Open Banking has increased and so have cyberattacks. More than ever, the industry must ensure the robustness of their systems and operate good transaction surveillance in order to maintain our clients trust. Today, Adriana invites Thomas Feld to discuss Managing Risk and Transaction surveillance.

- Adriana Seidl, Structuring for FIs, Institutional Cash Management, Deutsche Bank

- Thomas Feld, Business Product Manager, Cash Management, Deutsche Bank

Register

To register for The Deutsche Bank Festival of Finance, click here

And be sure to register for free online access to the Sibos 2021 experience on www.sibos.com

Explore Sibos 2020 insights and videos here.

Guide to Sibos 2021

Press contact

Frank Hartmann

frank.hartmann@db.com

Marketing contact

Maria Senior

maria.senior@db.com

Event contact

James Dudney

james.dudney@db.com